“When we see contractors struggle, it’s typically not because of insufficient profitability or total volume,” explains ProNovos Product Manager Kevin Bright, who serves as a liaison between ProNovos’ technical team and the company’s contractor customers. “It’s making sure they have enough cash to fund their operations.”

Published March 16, 2023 . 7 mins read

Introducing Cash Flow-Forecasting By ProNovos

Business

Product Updates

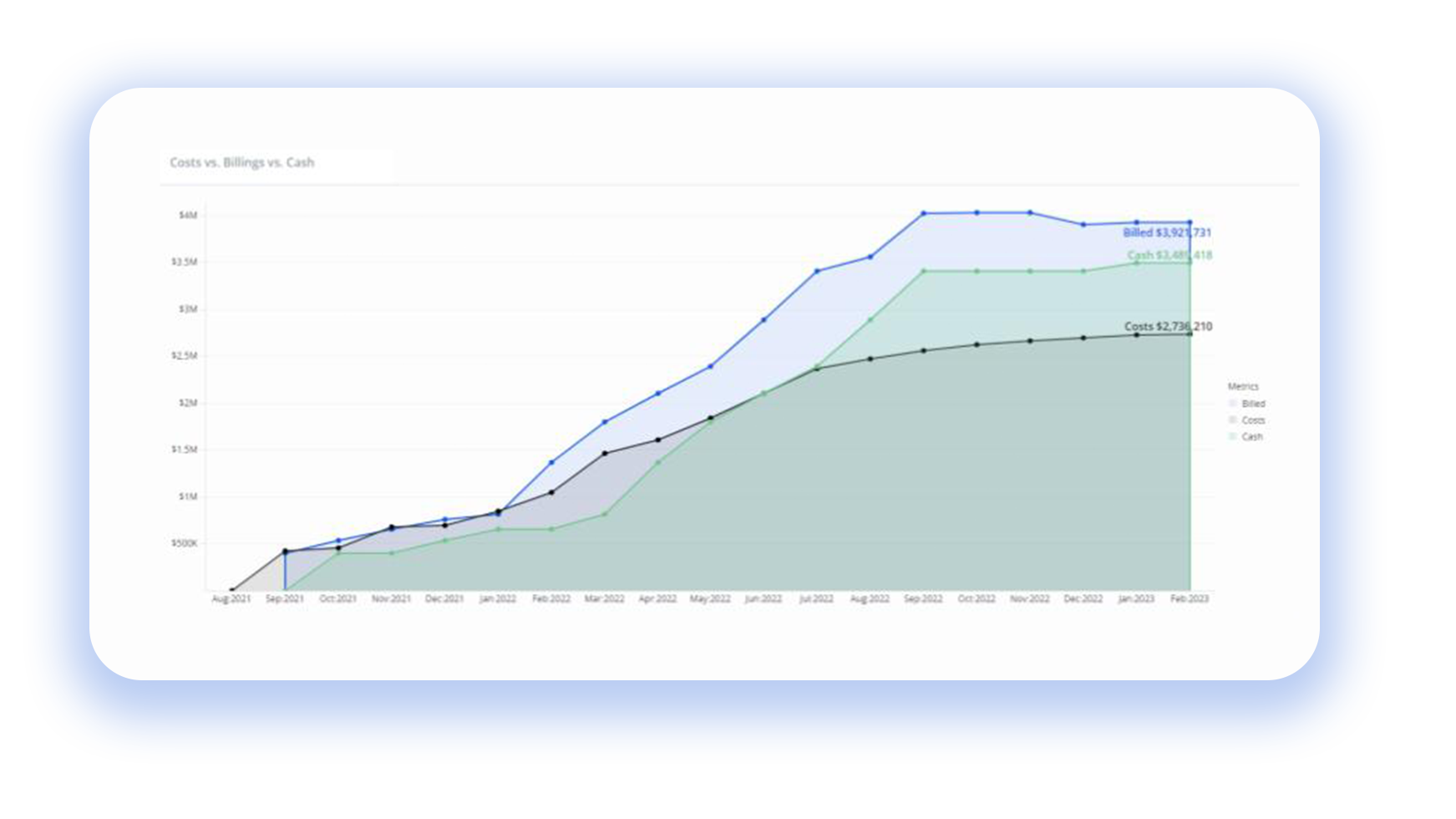

Bright kicks off a webinar showcasing the project financial timeline available within the project financial dashboard. The data visualization illustrates one of the challenges of construction cash-flow management.

The graph (“Cost vs. Billings vs. Cash”) shows three key data points:

Dollar amounts are plotted vertically. The horizontal axis represents the project timeline. At first glance, all seems well, since the amounts billed and received are floating above incurred costs.

“Total billed amount is almost $4 million on the project while our costs are only about 2.7 million, so that’s over a million dollars in profit and extremely healthy margin on the job,” says Bright, who was a project manager for more than seven years at specialty contractor Outside The Lines, Inc. (OTL).

But a closer look reveals a pattern that is familiar to any experienced PM: The first costs on the project were incurred in August 2021, but the project wasn’t cash-flow positive until around July 2022—or almost a year later.

“This is the nature of construction, right?” Bright says. “There’s always going to be that delay from when you experience the cost to when you get paid for those costs. Ensuring you have a good process in place to manage that delay is essential.”

Having enough cash on hand is the only way for contractors to keep materials flowing to the jobsite, make payroll and fund the rest of their operations and obligations. Unpredictable or slow payments, as well as retainage (whereby the customer withholds, say, 10 percent of payments until the project is complete) can make it harder to accomplish that goal.

“With retainage, right out of the gate you’re putting yourself 10% in the hole on your cash flow,” Bright said. “It’s just one more obstacle to staying ahead of the game.”

“

This is the nature of construction, right? There’s always going to be that delay from when you experience the cost to when you get paid for those costs. Ensuring you have a good process in place to manage that delay is essential.

Kevin Bright

Product Manager, ProNovos

Tracking Inflows–Right from the ERP

To introduce the new tool, Bright shares his screen and fires up ProNovos to show the audience a 13-week cash flow forecast.

Fields include:

Office and field personnel can use the dashboard to gauge how the company’s current trial balance might change over the 13-week period, based on their projections related to outstanding AR and AP.

Users set up this 13-week view by accessing a list of all cash GL accounts and all liability accounts, pulled directly from the ERP system.

“You can go in and select what GL accounts you want to include in your cash balance,” Bright explains. “The system looks at all previous transactions and gives you that current trial balance today.”

That current trial balance is the beginning balance for the first week. Users can drill into two buckets of information that tie into it, pulled each night from the ERP system with no need to enter invoices: “Inflows” (AR to be collected over the next 13 weeks) and “outflows” (AP).

Users can go into the system to update projected payment dates, and the new information will affect related variables in the dashboard across the 13-week timeline.

“So I can see I’m projecting to receive $356,000 in payments this week,” Bright tells the audience. “If I want to see specifically what those payments are, I can click on this year and ProNovos will give me all the invoices that I anticipate to receive in the week of March fifth. I can see the amount of each of those invoices I expect to receive, as well as the projected payment dates.”

By selecting an invoice, users can update the projected payment date—for example, they might push it out from the beginning of the month to the 14th and enter “missing paperwork” or other comments as the reason for the change. The system will record and display any previous adjustments as well.

“You can really keep track of all of your payment dates for the various invoices using this tool,” Bright explains. “It’s a really good way to make sure you’re staying on top of your collections and that things aren’t slipping through the cracks. It helps you get all those payments in as quickly as possible.”

The system makes it easy to add inflow items—for example, payments that will be coming in but for which no formal invoices are yet available—with fields for the description, amount, frequency and start and end date of those income sources.

“Let’s say it’s $25,000 and I’m going to receive it weekly starting today for the next two months,” Bright says. “Now when I look at my total inflow for each of those weeks, I will see my AR collections plus any of these ‘other’ items.”

“

You can really keep track of all of your payment dates for the various invoices using this tool. It’s a really good way to make sure you’re staying on top of your collections and that things aren’t slipping through the cracks. It helps you get all those payments in as quickly as possible.

Kevin Bright

Product Manager, ProNovos

Tracking and Managing Outflows

“Outflows” works the same way, pulling AP invoices directly from the ERP, with the same capability to introduce additional items. “Maybe it’s your rent payments or anything else paid out on a weekly or monthly basis,” Bright explains.

Naturally, payroll data is part of the outflow calculation as well.

Once users have adjusted both inflow and outflow based on the information they have in hand, the dashboard shows net cash flow—essentially the delta between those two variables.

“The beginning balance plus my net cash flow for the week gives me my forecasted end balance,” Bright explains. “My forecasted end balance for the prior week then becomes my forecasted beginning balance for the next week. That gets automated right up at the top of the tool, and then you go through the same exercise again as needed.”

He wraps up the webinar by summarizing the utility of the dashboard, which is now available for ProNovos users.

“This really gives you a way to make sure you’re staying on top of your cash flow from a company standpoint. You’re projecting out when you’re going to receive or make payments. It gives you an edge.”

Want to see the Cash Flow Forecasting tool and what else ProNovos has to offer live? Schedule a demo.

“

This really gives you a way to make sure you’re staying on top of your cash flow from a company standpoint. You’re projecting out when you’re going to receive or make payments. It gives you an edge.

Kevin Bright

Product Manager, ProNovos