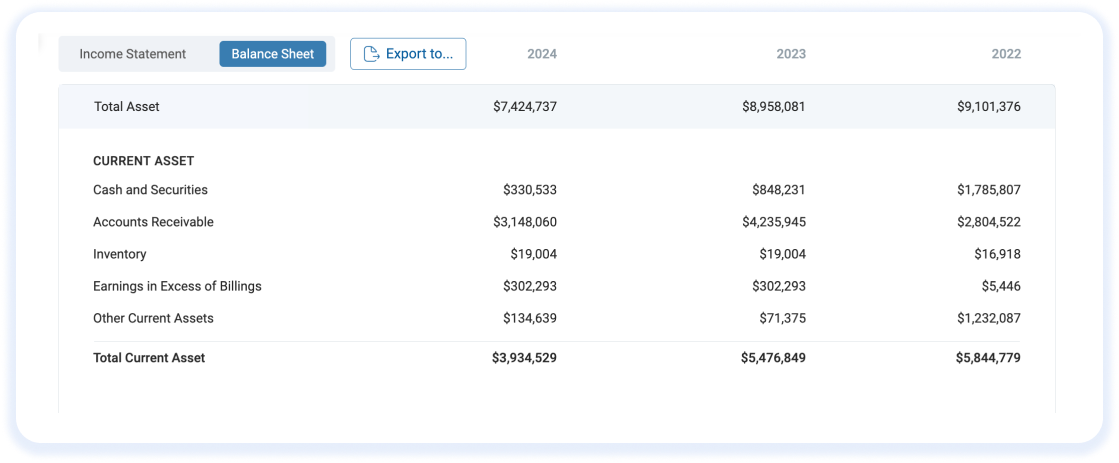

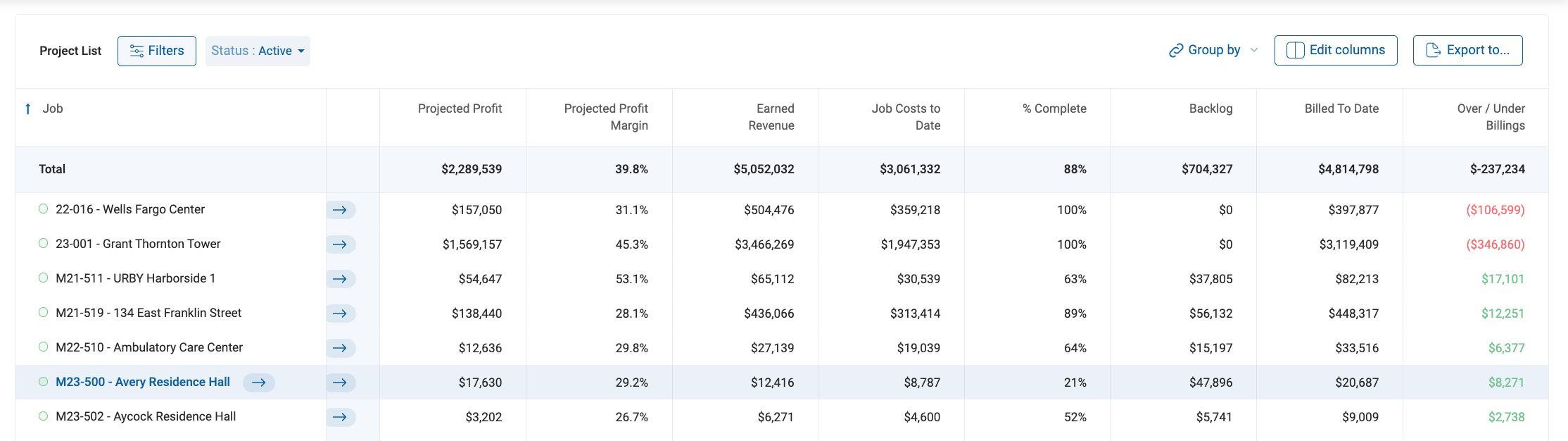

As a CPA in public practice, the jobs in process and closed job schedules (“job schedules”) are the most important schedules we use to perform audits, reviews, and general business consulting. Why? Because each individual project is its own profit center, that affects the contractor’s balance sheet and income statement. In addition, the jobs in process schedule is the mechanism used to calculate revenue. Because the percentage of completion revenue is driven by an estimated cost at completion number, there is an inherent risk that revenue could be misstated.

The following are the steps I undertake to analyze the job schedules and gather information that allows me to be comfortable that they are materially accurate.