In the fast-paced and competitive world of construction and project management, financial metrics are the cornerstone of successful project execution. Understanding and leveraging these metrics empowers Project Managers (PMs) to protect profits, forecast project costs, and ultimately drive the financial health of their projects. By staying on top of construction financial analytics, PMs can avoid costly mistakes, proactively identify profit fade, and ensure sustained cash flow. However, billing challenges such as retention, slow payments, and mismanagement of invoicing can pose significant hurdles. This blog highlights why mastering financial metrics is crucial for PMs and provides actionable insights on navigating the complex financial landscape of the industry.

Published June 21, 2024 . 4 mins read

Making Project Managers Savvy with Construction Financial Analytics

Business

Why It’s Important

PMs concentrate on building, adhering to schedules, and executing projects efficiently. To achieve complete ownership of their projects, PMs need to have a solid understanding of financial management components. Financial metrics are more than just numbers on a spreadsheet; they serve as essential indicators that offer PMs a comprehensive view of a project’s financial health. These metrics provide valuable insights into cost control, profitability, and financial risk, enabling PMs to make informed decisions. Without a firm grasp of these financial indicators, projects risk veering off course, resulting in profit erosion and financial instability.

Understanding Profitability and Cash Flow

Profitability

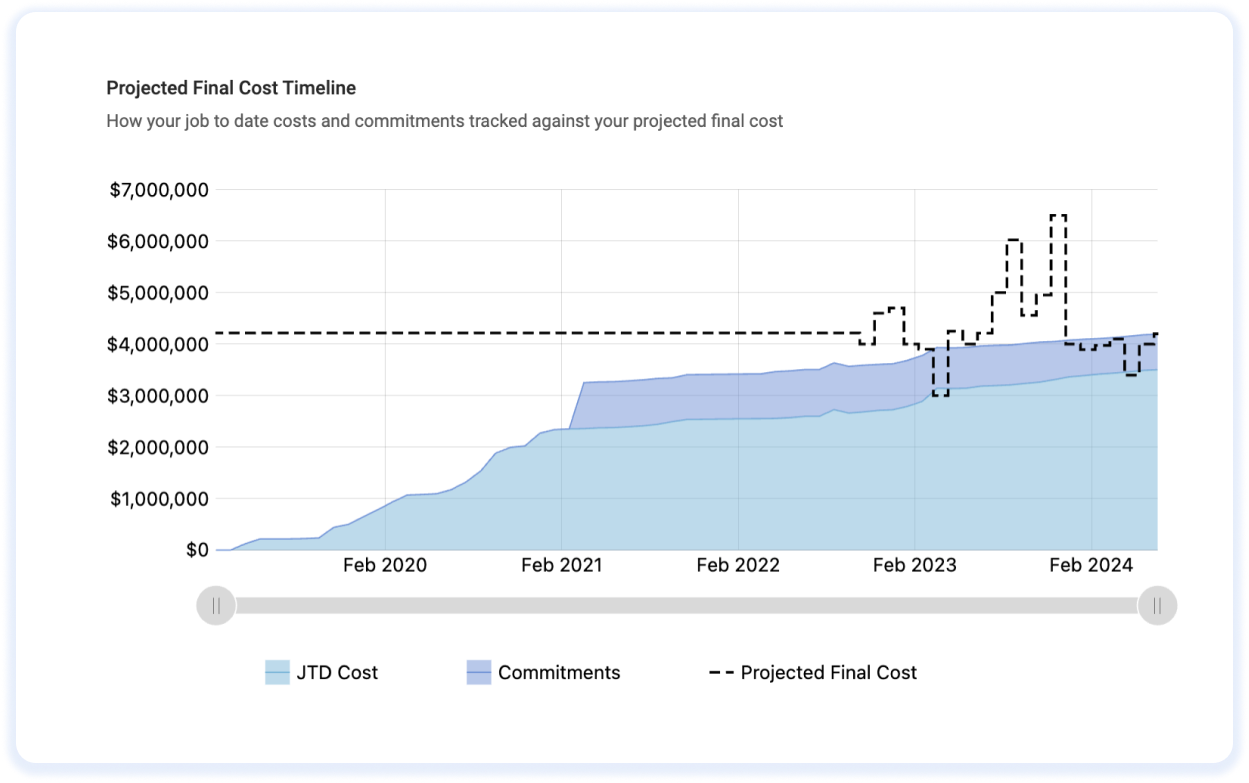

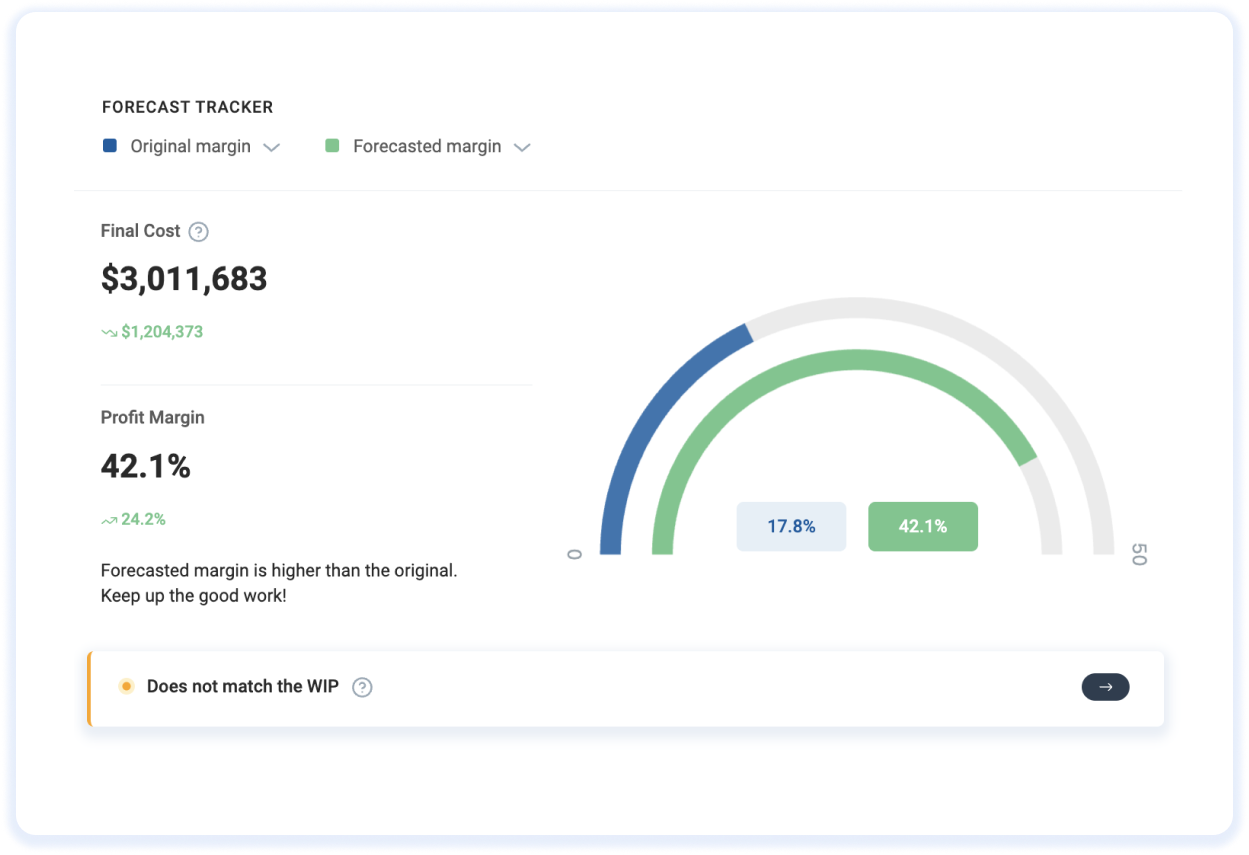

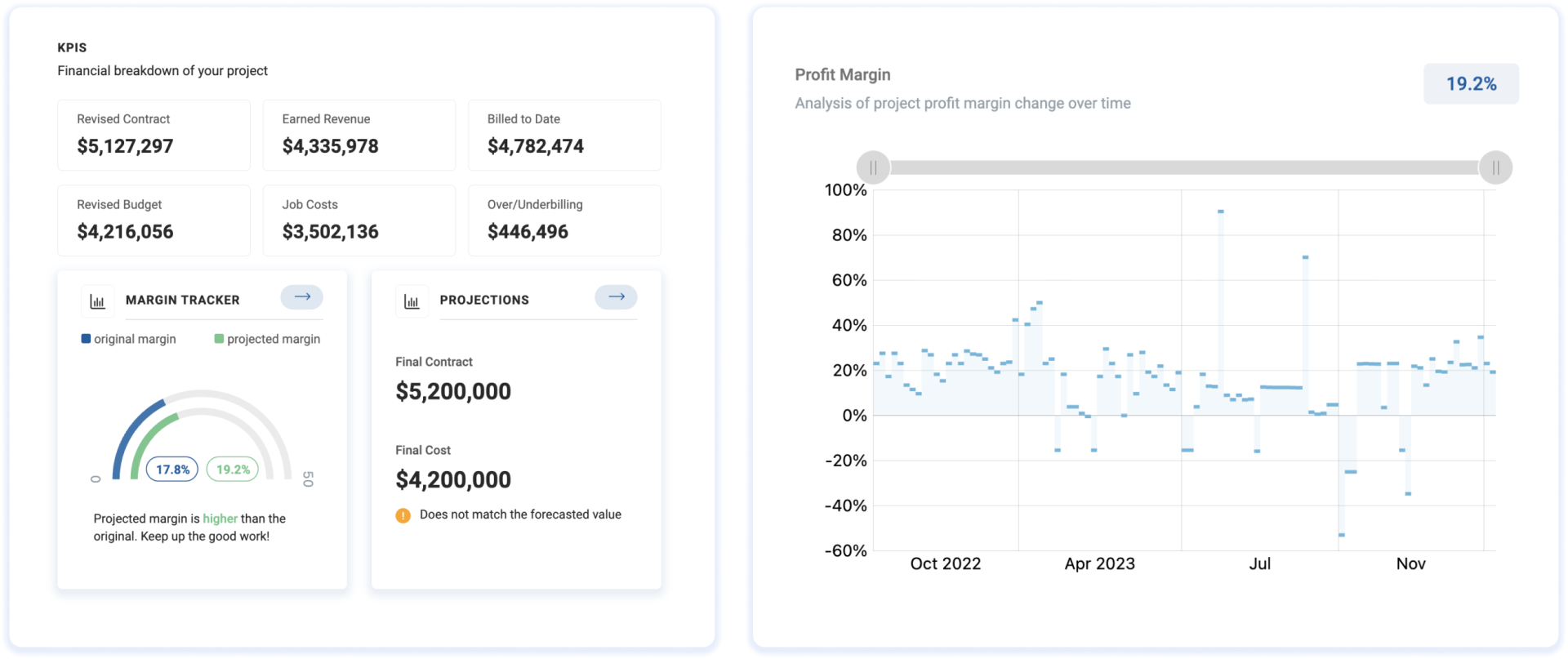

Understanding profitability metrics is important for PMs in terms of overall construction financial management. These metrics enable PMs to protect profits by closely monitoring and controlling project costs, accurately forecasting future expenses, and assessing the impact on revenue and profit. In construction, it’s critical to recognize that revenue does not equate to billings; revenue recognition follows the formula of incurred costs divided by project final costs. This distinction is crucial for accurate financial reporting and planning. By mastering these fundamentals, PMs can proactively identify profit fade, address potential issues before they escalate, and ensure the project’s financial health remains robust.

“

It is important for Project Managers to regularly update project costs during a project because projects are dynamic, and nothing goes exactly to plan. You could be beating the budget on labor hours, which may result in increased profitability, or going way over on hours and ultimately needing more resources to finish the project. There are also changes in scope during a project, and without adequately updating your estimated costs, you would misreport revenue and profit, which impacts the bottom line and financial decisions.

— Dan Stanhope, CPA, Partner, AAFCPAs

Cash Flow

For PMs, understanding cash flow is crucial for the success of their projects. Sustaining positive cash flow throughout the project is essential, preventing financial strain and ensuring smooth operations. Underbilling is a common issue, and it is vital to prevent it from escalating. Billing challenges, such as slow payments and retention, have long been prevalent in the industry. Effective management of invoices and diligent follow-ups are necessary to address these challenges. Timely follow-up on payments reflects the strength of the relationship with clients or subcontractors; shorter payment cycles often indicate healthy relationships, while longer cycles can suggest that the PMs might be getting taken advantage of by the general contractor or other inefficiencies within the company. Therefore, PMs need to understand the billing cycle and maintain robust invoice management to stabilize projects.

The shortlist of important metrics to monitor

Average Days to Pay

Percentage Complete

Profit Margin

Billing Progress

Retention

Tip

Request retainage relief. Usually, when the project is 50% complete, you can request a reduction in retainage. An example is reducing retention from 10% to 5% at 50% complete. Check contract terms, the defect liability period, and legal and regulatory compliance to understand if this option is available for your projects.

Additional Resource

To enhance the financial management of your construction projects and maximize profit margins, PMs need to understand essential financial concepts and learn from industry experts. This eBook covers key topics such as job costing, project forecasting, change order management, revenue recognition, billings, and project-level cash flow. Equip yourself or your team with the knowledge to navigate the financial landscape confidently.

Schedule a time to meet with a solutions advisor to learn more about ProNovos.