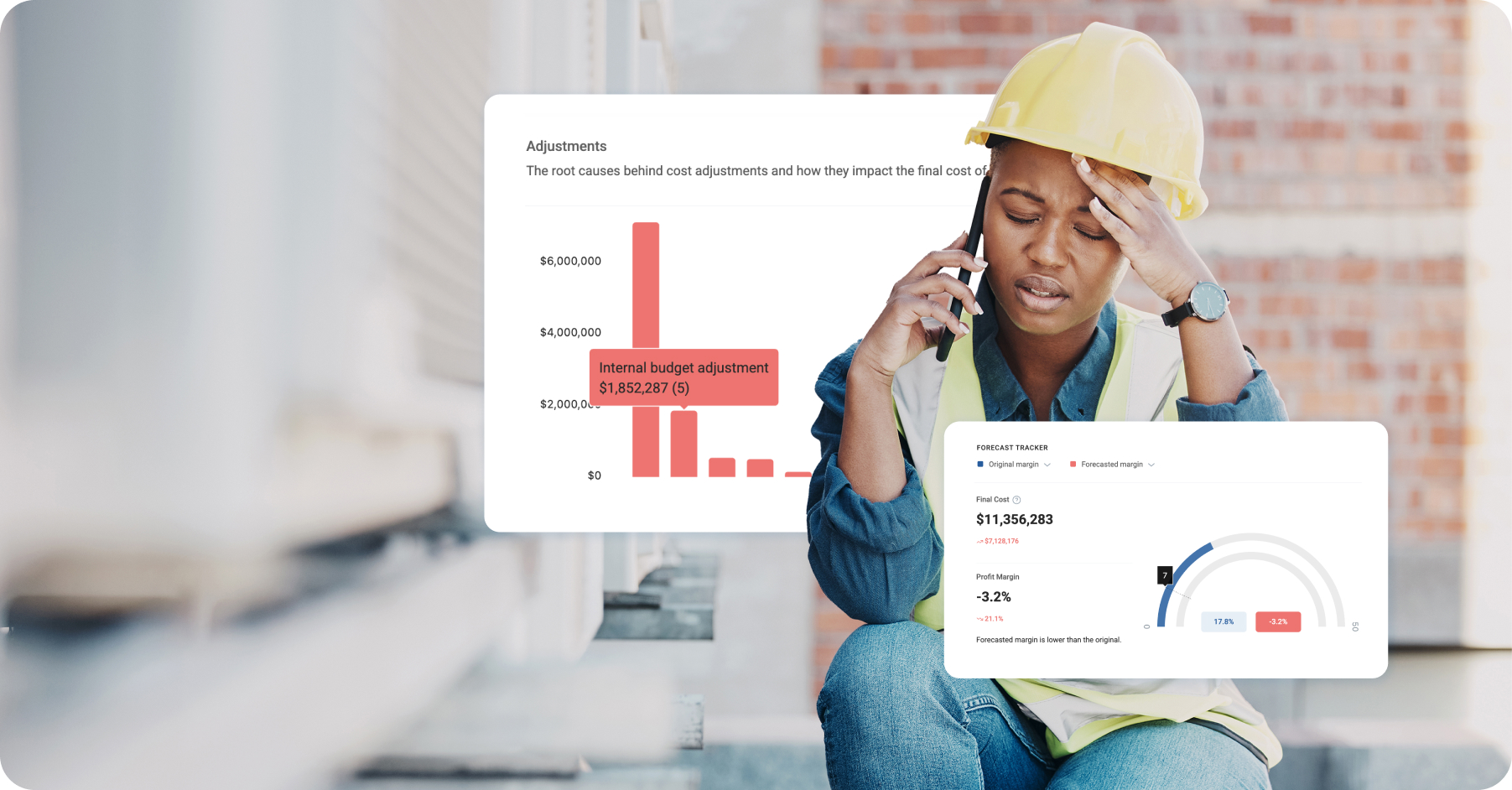

Are you leaving money on the table? For construction businesses, every dollar counts, and that’s where job costing comes in. Imagine having a clear line of sight into your project’s expenses, with the ability to pinpoint exactly where your budget is going. By assigning costs to each project in real-time, job costing ensures you stay on track and allows you to catch discrepancies before they snowball into profit-eating problems. Whether managing unexpected change orders or keeping cash flow steady, job costing is the ultimate tool to safeguard your profit margins and keep your projects in the black.

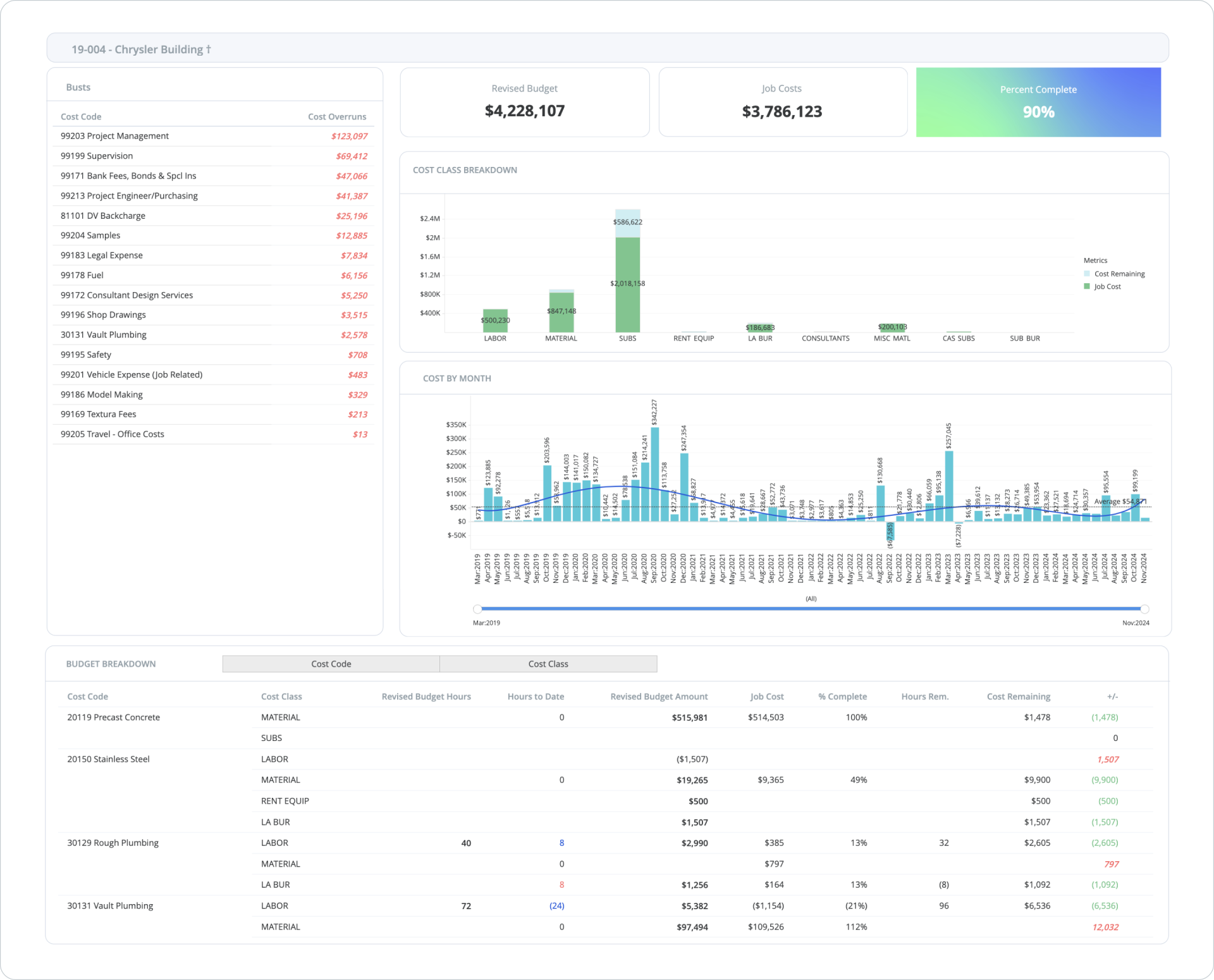

In addition to its project-level benefits, job costing ties directly to a construction business’s financial statements, impacting the income statement, balance sheet, and cash flow statement. This integration ensures that project-specific expenses are accurately reflected in overall financial performance. However, a consistent and reliable system must be in place for job costing to be effective. Without it, errors such as incorrect invoicing, inaccurate billing, and financial losses can occur. In this guide, you’ll learn how to implement job costing in construction, establish an organized cost code system, track and control costs, and optimize your financial management for better decision-making and improved profitability.