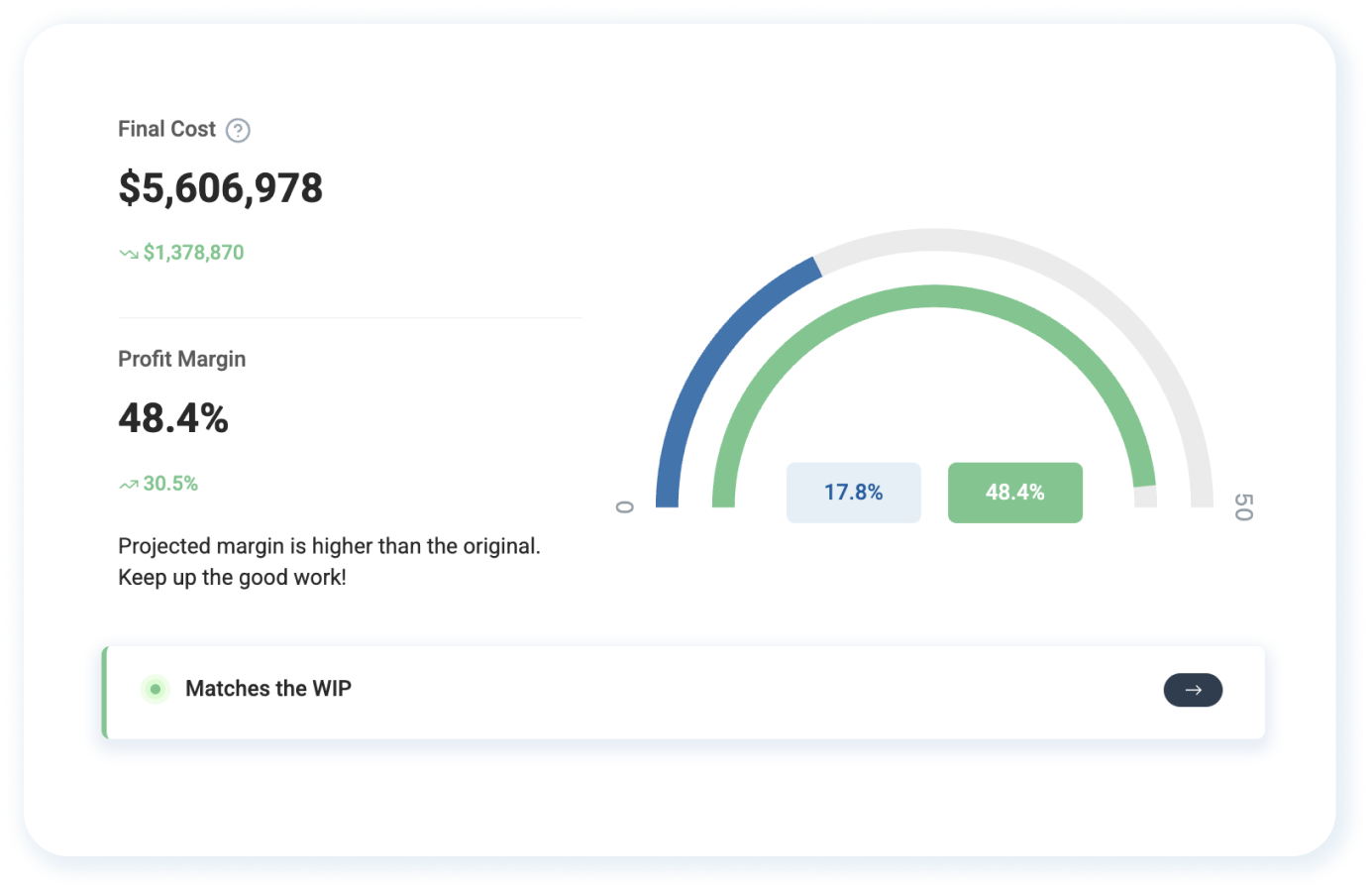

Profit fade is the gradual reduction in gross profit on a construction project as work progresses. It often starts subtly—an underestimated labor cost here, a delayed material shipment there—but can quickly add up, cutting into a project’s profitability. Beyond being a financial red flag, tracking profit fade is a form of self-evaluation. It allows contractors to analyze where profits are slipping and take corrective action before it’s too late. It signals to external stakeholders—such as surety underwriters and lenders—that job profitability is being monitored.

For example, imagine a contractor wins a $5 million job, expecting a 12% gross profit margin ($600,000). However, as the project unfolds, unexpected equipment repairs, rising material costs, and unfavorable weather conditions that extend labor hours push expenses higher. By the time the job wraps up, the profit margin has dropped to 7%, reducing profit to $350,000. That $250,000 difference is profit fade—money that was expected but never realized.