Every project starts with a forecast, but when that forecast is off, the financial consequences can be significant. While project managers (PMs) are often focused on schedules, materials, and manpower, there’s an undeniable truth: whether they like it or not, PMs are part of the financial engine that drives project profitability. A bad project forecast doesn’t just affect one job—it can create ripple effects that strain cash flow, delay decision-making, and reduce overall profitability.

Published March 21, 2025 . 6 mins read

The Cost of a Bad Forecast: How Poor Project Projections Drain Construction Profits

Business

Samantha Lake

Samantha Lake

COO, ProNovos

The Reality of Financial Responsibility in Construction

PMs may not have entered the industry with a love for accounting, but financial oversight is an inescapable part of the job. Inaccurate forecasting leads to real-world consequences—missed profit projections, over/underbillings, labor overruns, and project delays. Consider this scenario:

Chris is managing a $5 million commercial project. He underestimated labor in the final stages and had to make a last-minute adjustment to his project forecast. This last-second revision led to an unexpected profit margin fade, potentially forcing him to record a negative profit for the current period if revenue and profit were previously overstated.

Had Chris been monitoring his project financials more closely, he would have caught that he was 15% underbilled—an early warning sign of both cash flow constraints and potential budget overruns. With this insight, he could have adjusted his forecast proactively or, better yet, identified the root cause of the overruns and submitted a change order to protect his margins and prevent further financial setbacks.

This is a common challenge, not because PMs are neglectful but because they often lack the tools or processes to stay ahead of the financial curve. They’re builders, problem-solvers, and leaders, but they can only make informed decisions when they have the right data at the right time.

Common Financial Headaches from Poor Forecasting

Over/Underbillings

Inaccurate billing affects cash flow, and underbillings can lead to cash shortages and be an early indicator of budget overruns or missed change orders, while overbilling can be a source of needed cash flow but require the PM to understand what is contributing to the overbilling.

Budget Overruns

When costs outpace the budget, profitability erodes. Poor forecasting often leads to missed budget signals until it’s too late.

Change Orders

If change orders aren’t accurately tracked and processed, it can result in disputes, unpaid work, or lost profit.

Labor Fluctuations

Without tracking current labor costs, it’s easy to overspend, especially during project crunch periods.

Materials Costs

Sudden spikes in material costs can blow budgets apart if they’re not monitored and forecasted effectively.

Delays and Schedule Impact

Delays cost money, but poor forecasting can lead to avoidable delays due to late material orders or labor shortages.

Why PMs Struggle with Financials

Limited Financial Background & Training

Most PMs come from apprenticeships, field experience, or construction science or engineering degrees—not accounting or finance. Without formal financial training, concepts like cash flow management or over/underbilling can feel like a foreign language, making integrating financial oversight into their role difficult.

Limited Access to Data

PMs often depend on accounting teams for financial updates, which may only come monthly—too late for proactive decision-making.

Paperwork Fatigue

Most PMs are drawn to building, not paperwork. Financial reporting feels like an added burden rather than an integral part of their role.

How to Simplify Financial Management for PMs

1. Immediate Access to Current Financial Metrics

Empower PMs with tools that provide up-to-date information on project costs, labor hours, and billing status, enabling timely, informed decisions.

2. Simplify Reporting

Use dashboards that clearly highlight key financial metrics—like labor costs, materials expenses, and billing status.

3. Training and Support

Offer basic financial training to help PMs understand concepts like forecasting, over/underbillings, and cash flow impact.

4. Streamline Processes

Reduce paperwork by automating financial tracking where possible, giving PMs more time to focus on the field.

Light at the End of the Tunnel

The good news? These financial headaches are avoidable. One major barrier for PMs is the complexity of traditional financial reports—especially when buried in spreadsheets. For many, deciphering rows of data in Excel can feel overwhelming, particularly for those who don’t consider themselves “numbers people.”

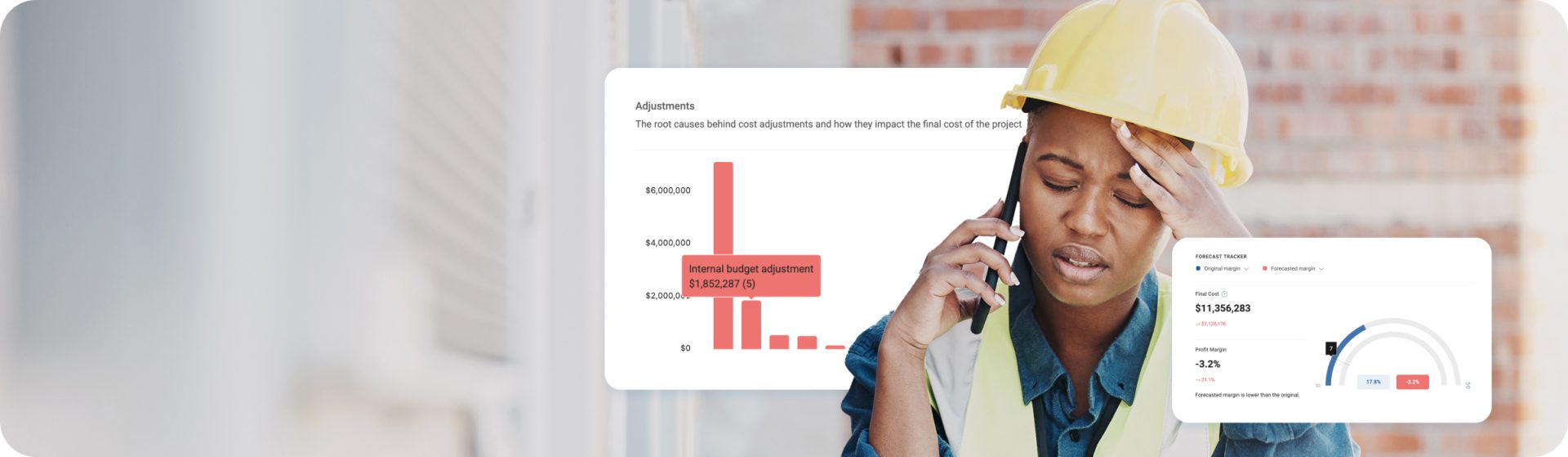

Scott Ai, Vice President at Beachside Roofing and ProNovos client, put it this way, “Even for those who don’t have an accounting degree or aren’t savvy in construction financial management, the visuals in ProNovos make it easier (for Project Managers) to process information.”

That’s where ProNovos makes a difference. Our intuitive dashboards use visuals and graphics to present financial data in a way that’s easy to understand at a glance—no accounting degree required. PMs can quickly identify trends, catch potential issues, and make informed decisions faster, helping protect profitability and keep projects on track.

Real-World Application

Alex, a PM on a large infrastructure project, started using ProNovos. Within two months, she noticed a rise in labor costs. By catching the issue early, she was able to adjust schedules and reallocate resources, preventing an overrun, keeping the project on budget, and protecting the company’s profit margins.

The Bottom Line

Forecasting isn’t just the finance team’s responsibility—it’s a team effort. When PMs are empowered with financial insight, they can take action sooner, avoid costly mistakes, and drive better project outcomes.

But having the right tools in place is key to making this happen. It’s not just about access to data—it’s about how easily that data can be understood and acted upon. Unlike solutions like Power BI, ProNovos doesn’t require hiring additional staff or consultants. You can be up and running in just 24 hours with a seamless integration into your existing ERP. It’s designed to simplify complex data and empower PMs to make better decisions without the need for extensive setup or training. Put the power of technology to work for you and see for yourself what makes ProNovos different. Before you decide if you need it, take a look. You might be surprised by what you’ve been missing.