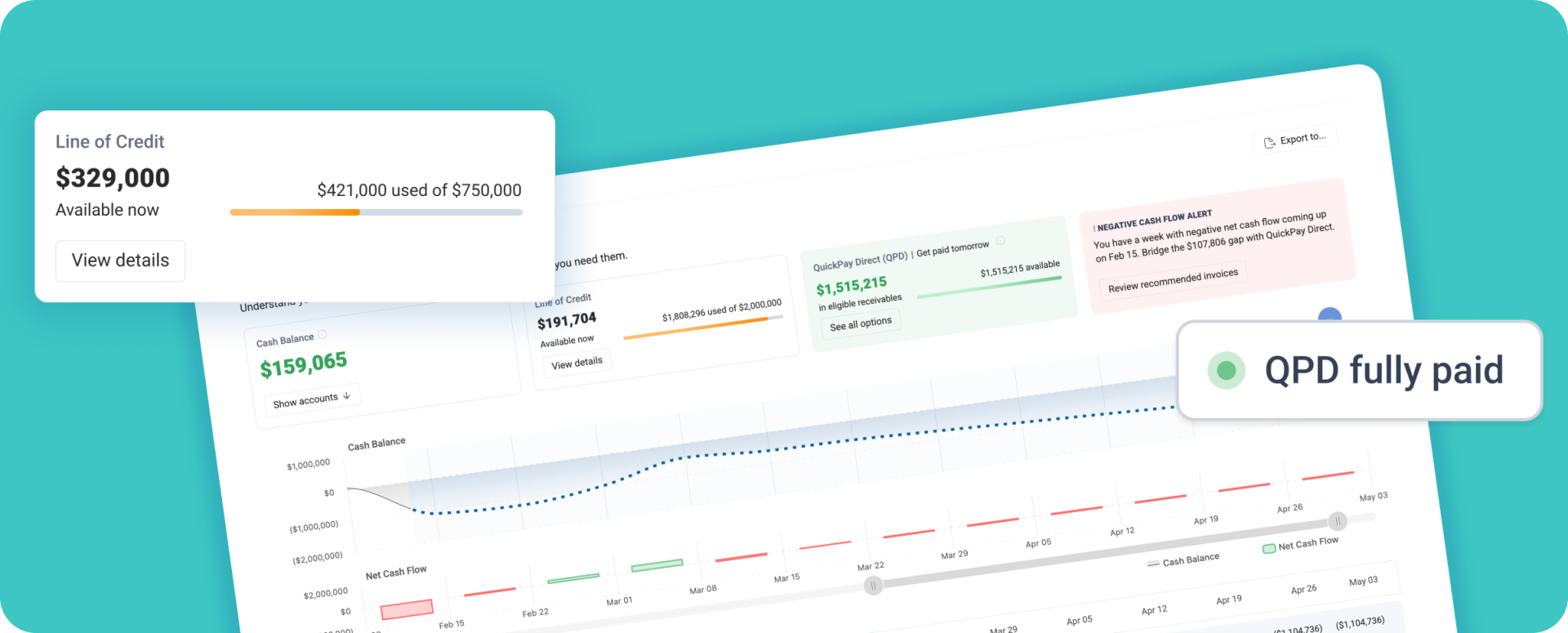

The updated Cash Flow Forecast is designed to do one thing well: show you where your cash is going to be before you get there. The module projects your cash position 13 weeks out, across every active project. It pulls from the data you’re already tracking in ProNovos and translates all of it into a week-by-week picture of money in and money out.

But what makes it more than a pretty chart is the forecast actually understands how construction payments work. When a subcontractor bills in April, they don’t get paid in April. They get paid in May, maybe June, depending on terms. So we built configurable lag settings that shift your projections to reflect when cash actually moves, and not when the paperwork says it should.

When a project is running a cash deficit, you’ll see it in advance, with enough lead time to actually do something about it. That “something” is QuickPay Direct.

QuickPay Direct is invoice early payment built into your workflow. When your forecast shows a shortfall or when you just want to get paid faster on a specific invoice, you can request early payment directly from the module. You select an invoice, request funding, and receive payment in as little as 24 hours. A small, transparent discount is applied, and your GC never needs to know and change their process. When they eventually pay the invoice, the payment goes to us.

A few things we obsessed over while building this:

Transparent pricing, always. We advertise no hidden fees, and we mean it. The variable discount on each invoice is shown upfront, before you request anything. If the numbers don’t work for you on a particular invoice, don’t use it.

Education baked into the product. Construction finance isn’t simple, and we don’t pretend it is. We added contextual tooltips and educational modals throughout the Cash Flow module. What’s a projected payment date? Why did your net cash flow change when you funded an invoice? These explanations show up when and where you need them instead of a PDF you’ll never open.

We built this because subcontractors deserve better than reactive financial management. You shouldn’t find out you have a cash problem the week it becomes a crisis. You should see it coming 13 weeks away and have the tools to fix it before it ever becomes one.

If you’re a ProNovos user, the updated Cash Flow Forecast is available now. If you’re not yet a user, let’s chat.