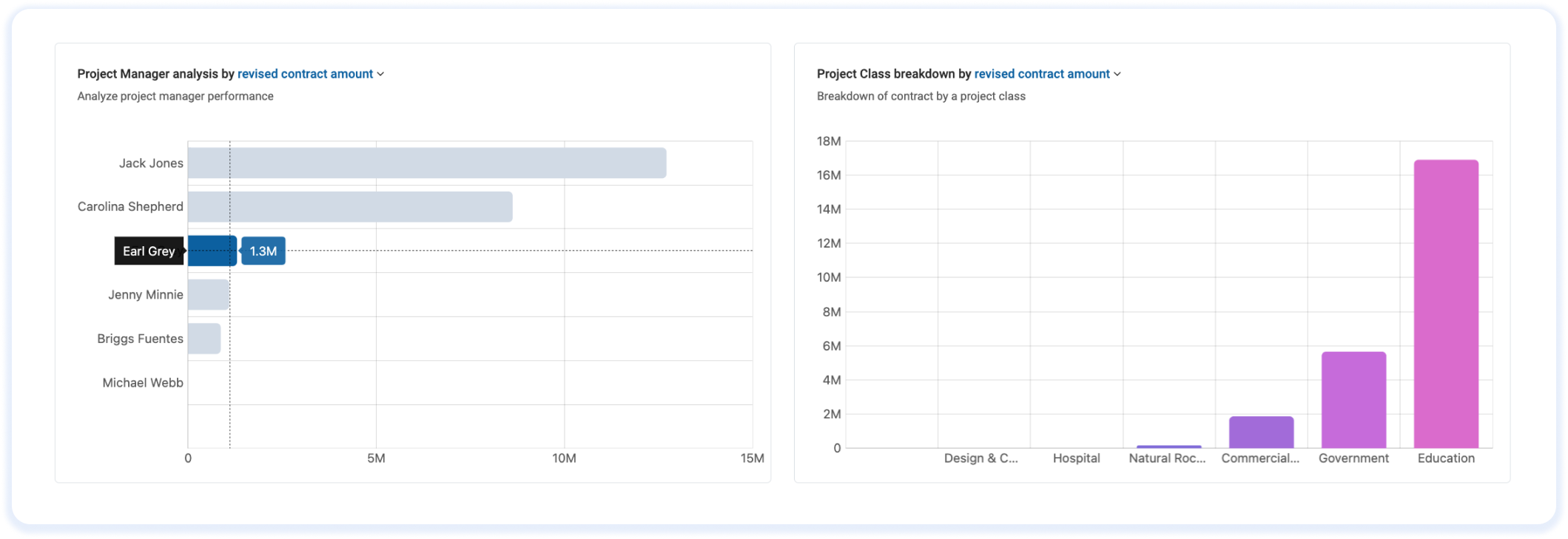

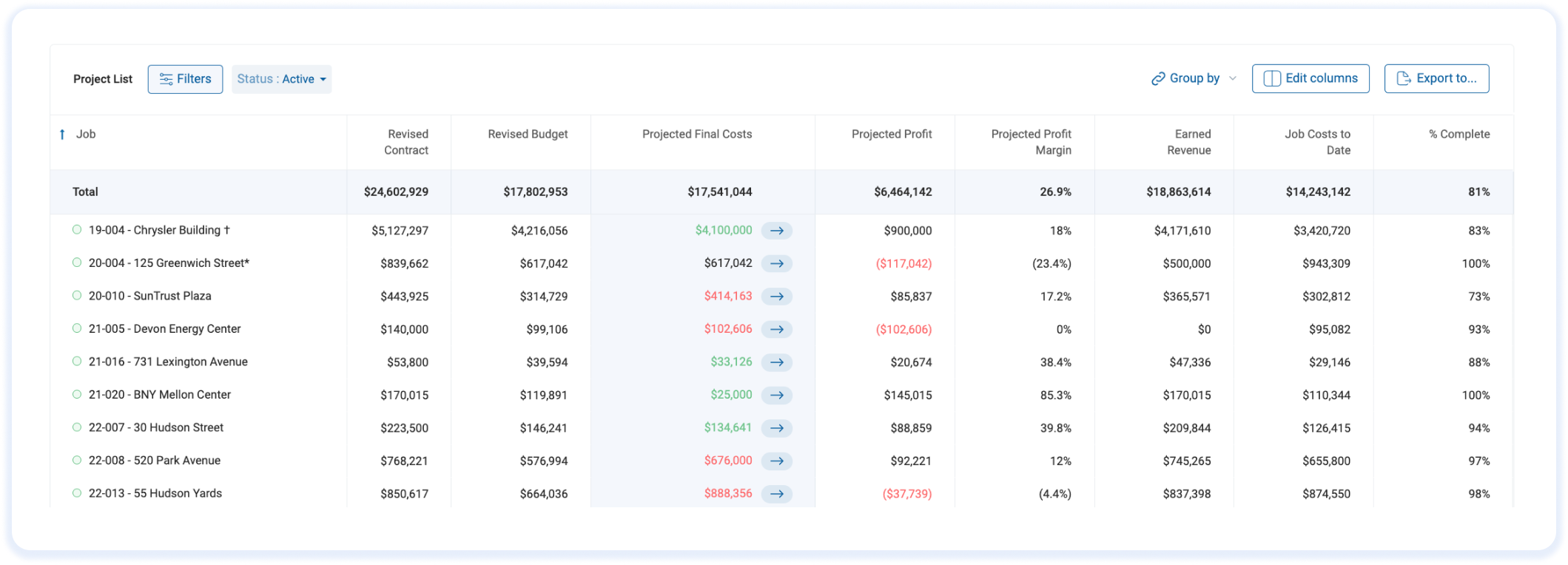

Over the past few months, I’ve pitched questions to contractors, CPAs, bankers, and surety firms about what they believe is a contractor’s most crucial financial tool. Unanimously, the answer came back: the WIP schedule. Diving deeper, I queried who impacts the WIP schedule the most. Once again, the consensus was clear: the Project Manager (PM). And on asking who’s tasked with keeping the WIP schedule current and accurate, the spotlight turned to the construction financial professional.

Reflecting on these insights, a compelling narrative begins to emerge…

Construction financial workflows, like baseball games, involve a complex interplay of strategies and roles, each requiring precise input from various players on the field. A misjudged play or a lapse in concentration can have far-reaching consequences, potentially jeopardizing the team’s success.

As someone who analyzes construction financial workflows through the lens of data science, here’s my perspective: