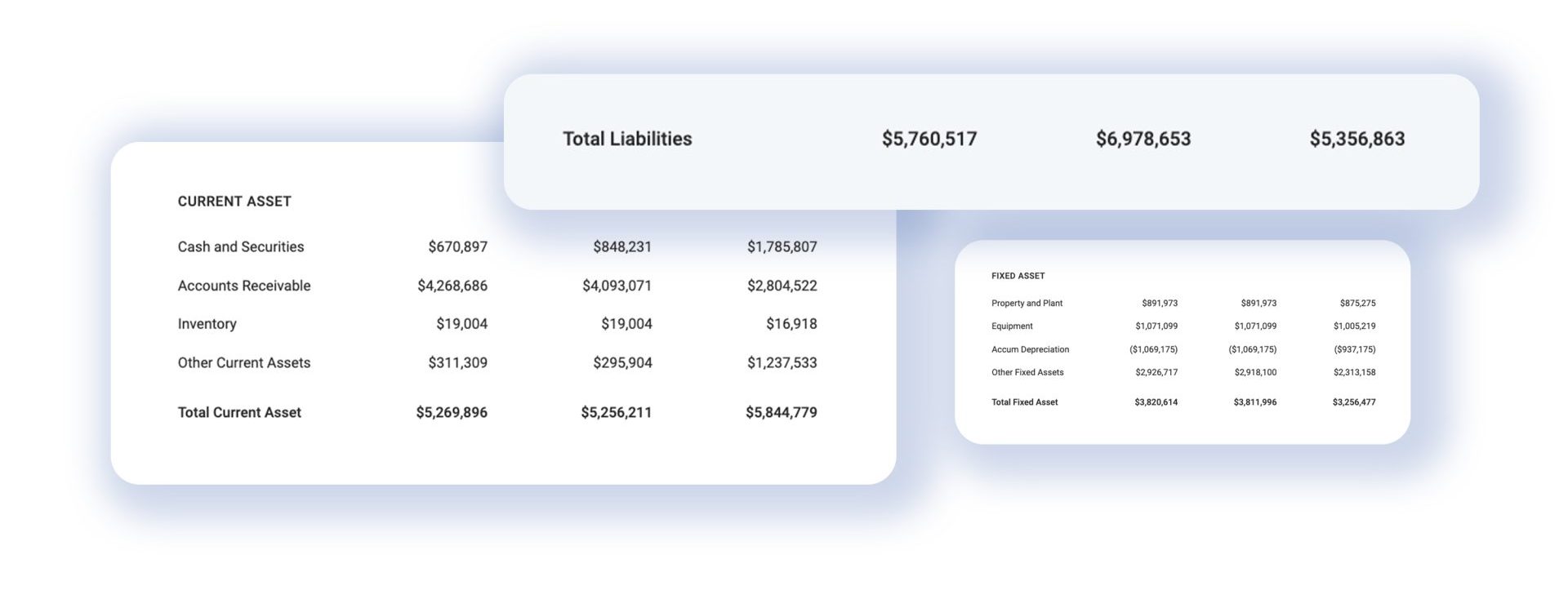

Assets = Liabilities + Owner’s Equity

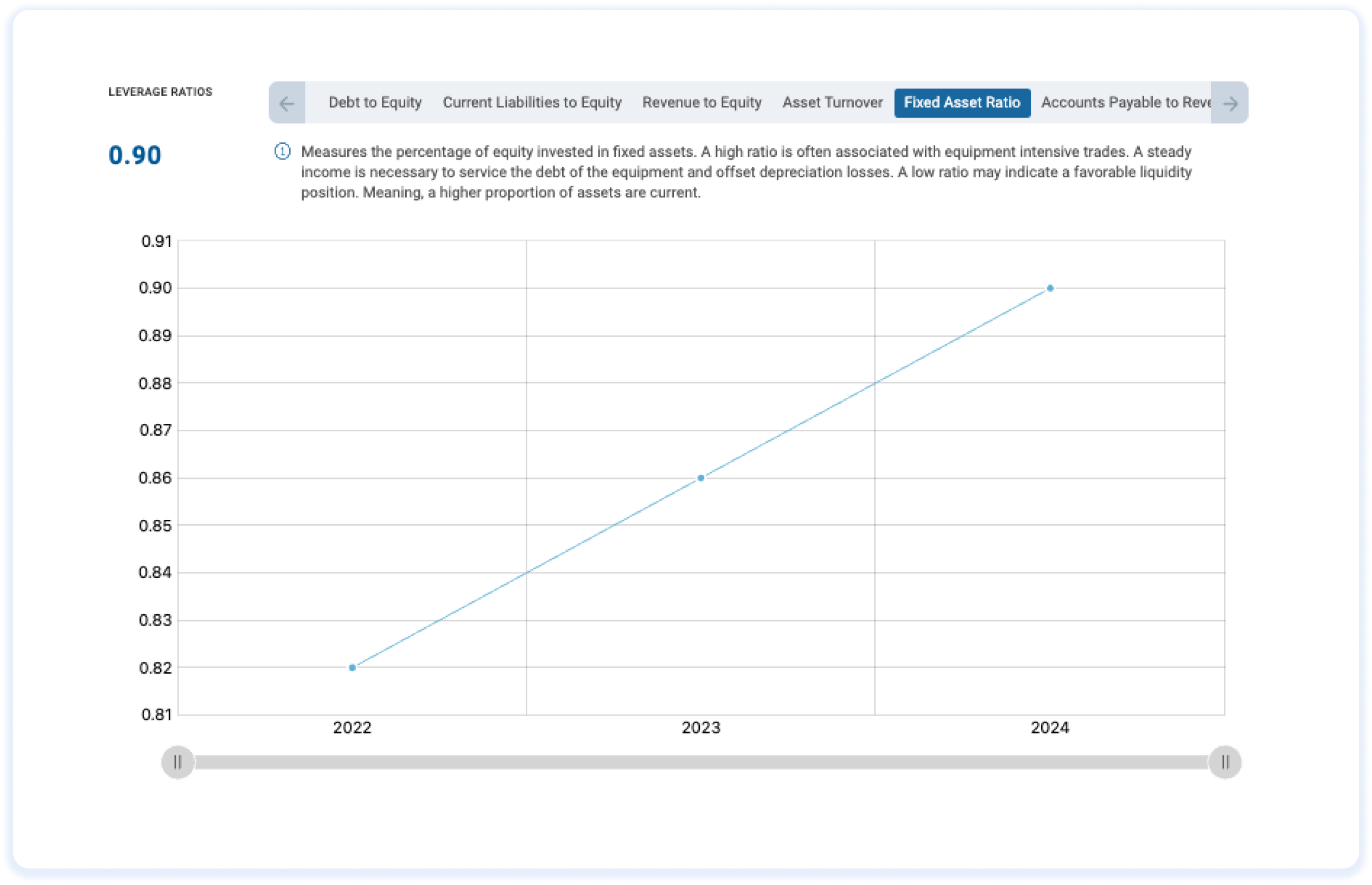

Navigating the intricacies of a balance sheet is a small feat, especially for professionals in a construction company who may need a strong accounting background. However, the ability to decipher this financial document is of paramount importance for individuals involved in the construction industry. It is one of the three main financial statements businesses must create: the balance sheet, income statement, and cash flow statement. The balance sheet is also home to many critical KPIs that give insight into the financial health of your business.

For those whose expertise lies in building projects rather than crunching numbers, understanding the balance sheet is a gateway to informed decision-making. This article has been crafted with you in mind, bridging the gap between construction know-how and financial acumen.