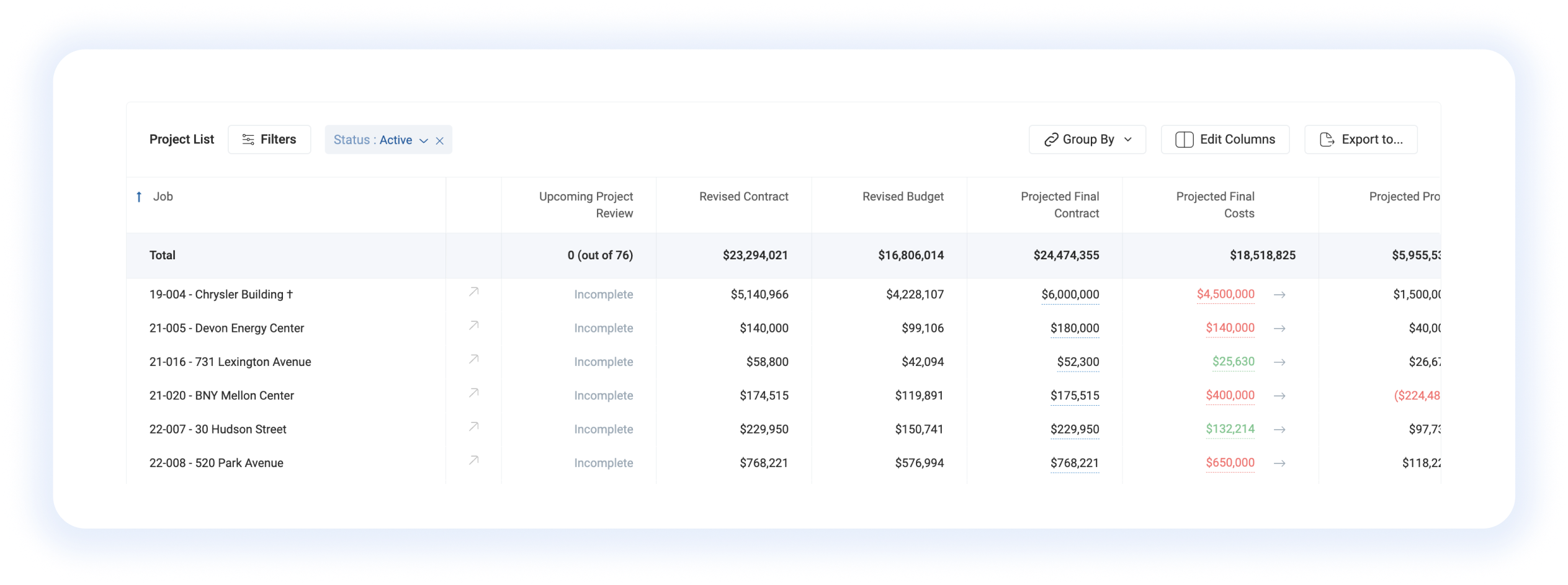

The 10 Essential KPIs to Include on Every WIP Report

A well-crafted and timely Work in Progress (WIP) report is essential for effective project management and financial oversight in the construction industry. Knowing which Key Performance Indicators (KPIs) to include can transform your WIP report from a simple progress tracker into a powerful tool for informed decision-making.

This checklist will guide you through the crucial financial KPIs that should be included in every construction business’s WIP report. These KPIs will enhance your internal project management while providing your external stakeholders with the necessary insights.

To develop this checklist, we consulted with a network of CPA firms that serve construction clients, business advisors, and construction executives to pinpoint the most critical KPIs for your WIP report. We’ve distilled their expertise into a list of essential KPIs, ensuring that your report offers the financial clarity and project insights necessary for your team and the financial professionals who rely on it.

Paul Atkinson, CPA

Paul Atkinson, CPA Bob Biehl, CPA, CCIFP

Bob Biehl, CPA, CCIFP