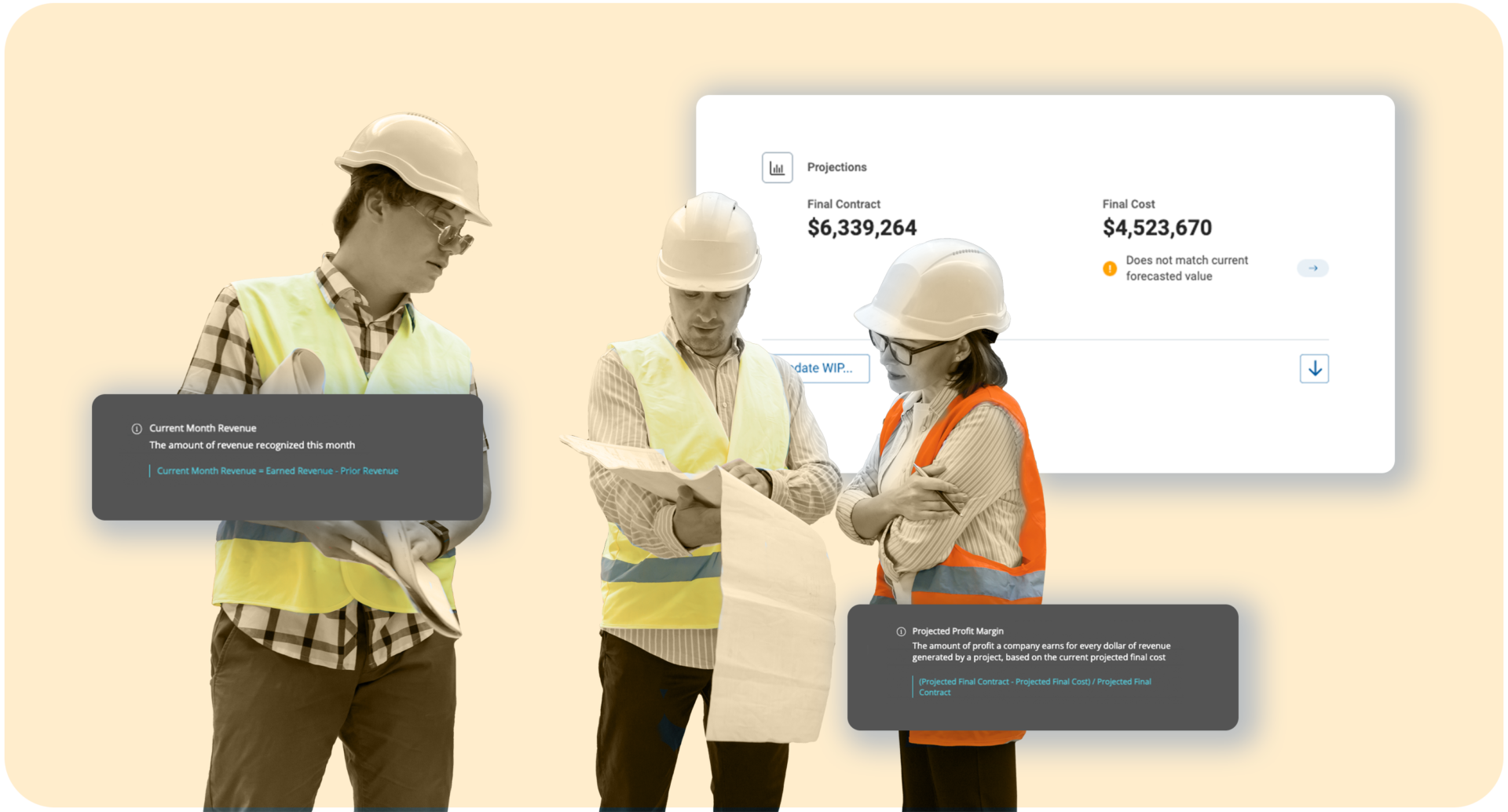

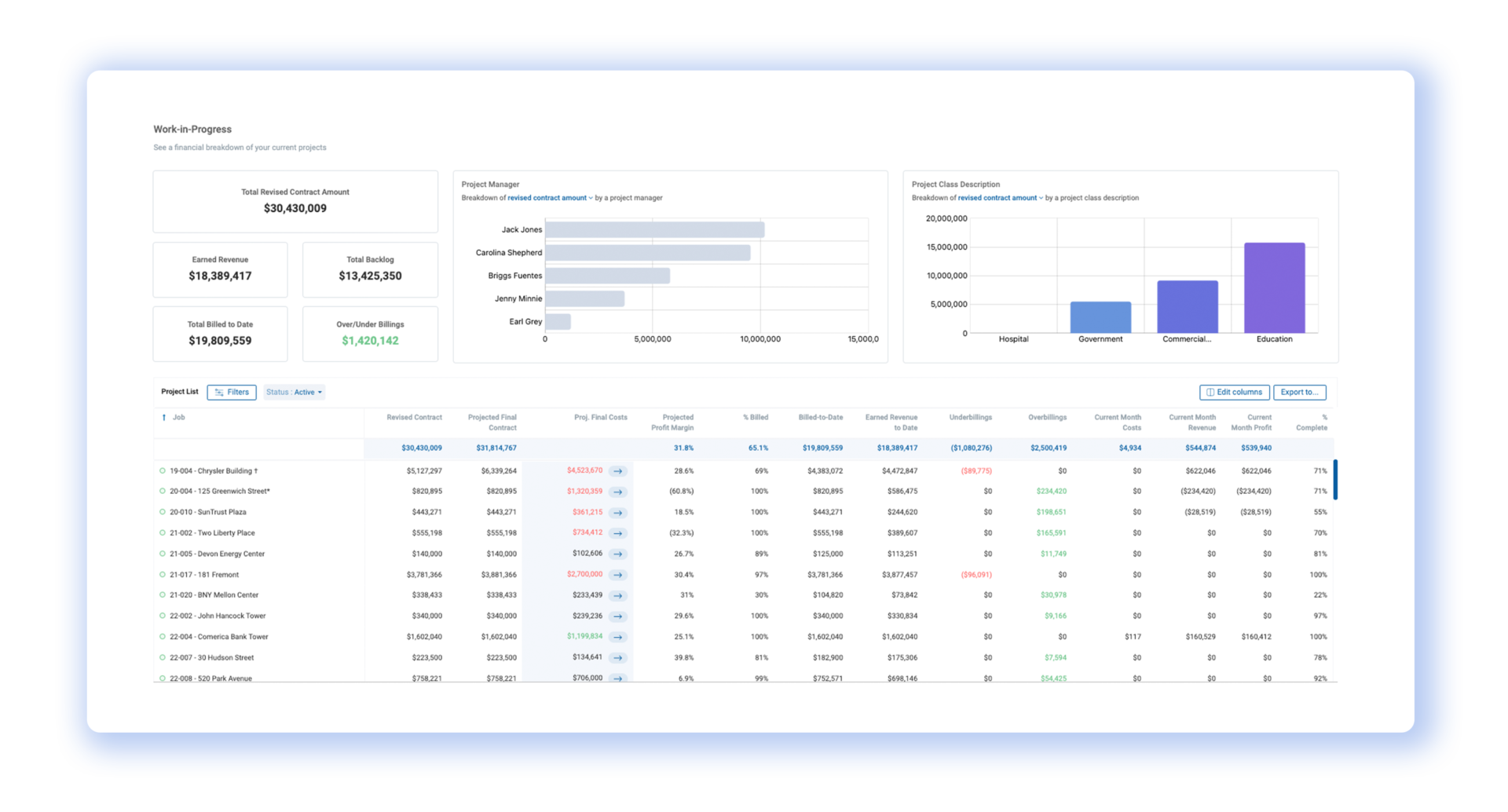

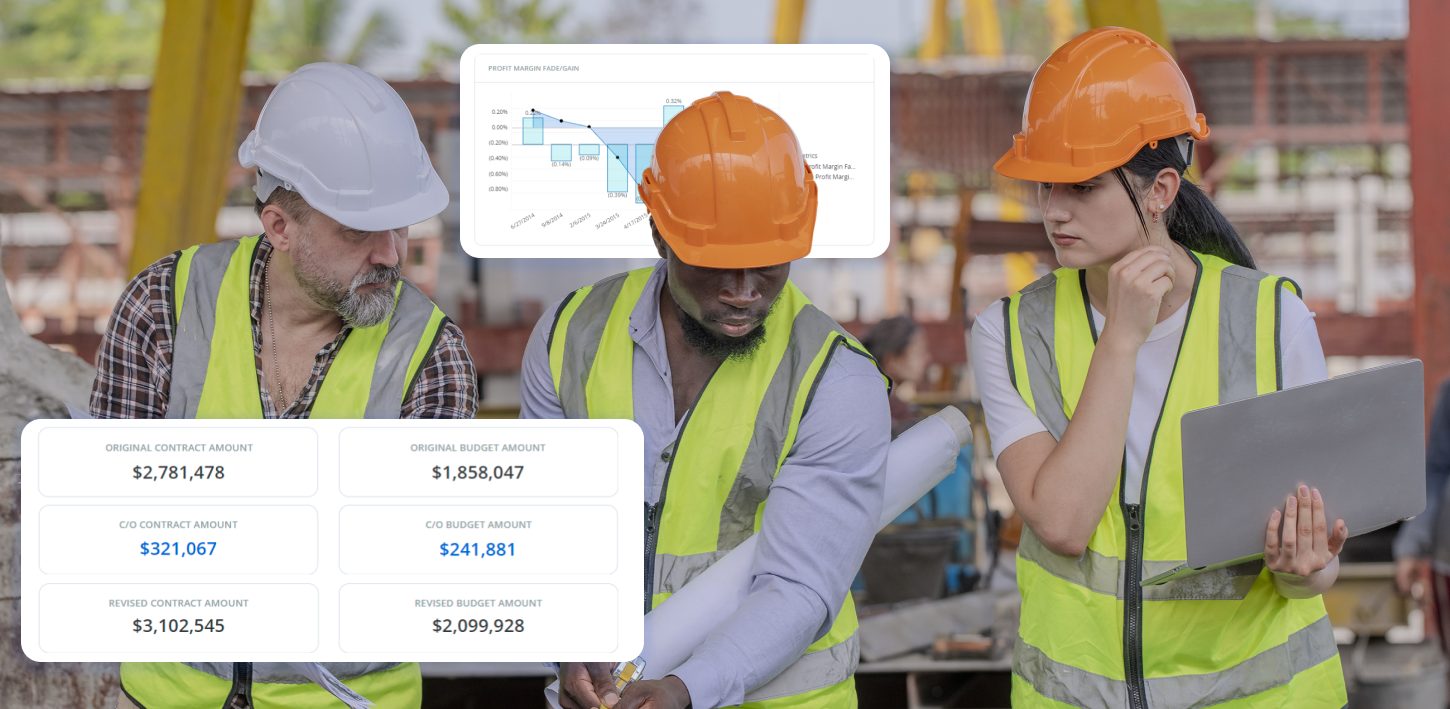

The WIP schedule is essentially the construction industry’s version of a report card. It shows a detailed breakdown of each project’s status, providing critical information such as costs incurred, revenues earned, and the overall profitability at any point during the project lifecycle. It allows for real-time tracking and assessment of performance, aiding in proactive decision-making, risk mitigation, and effective cash flow management.

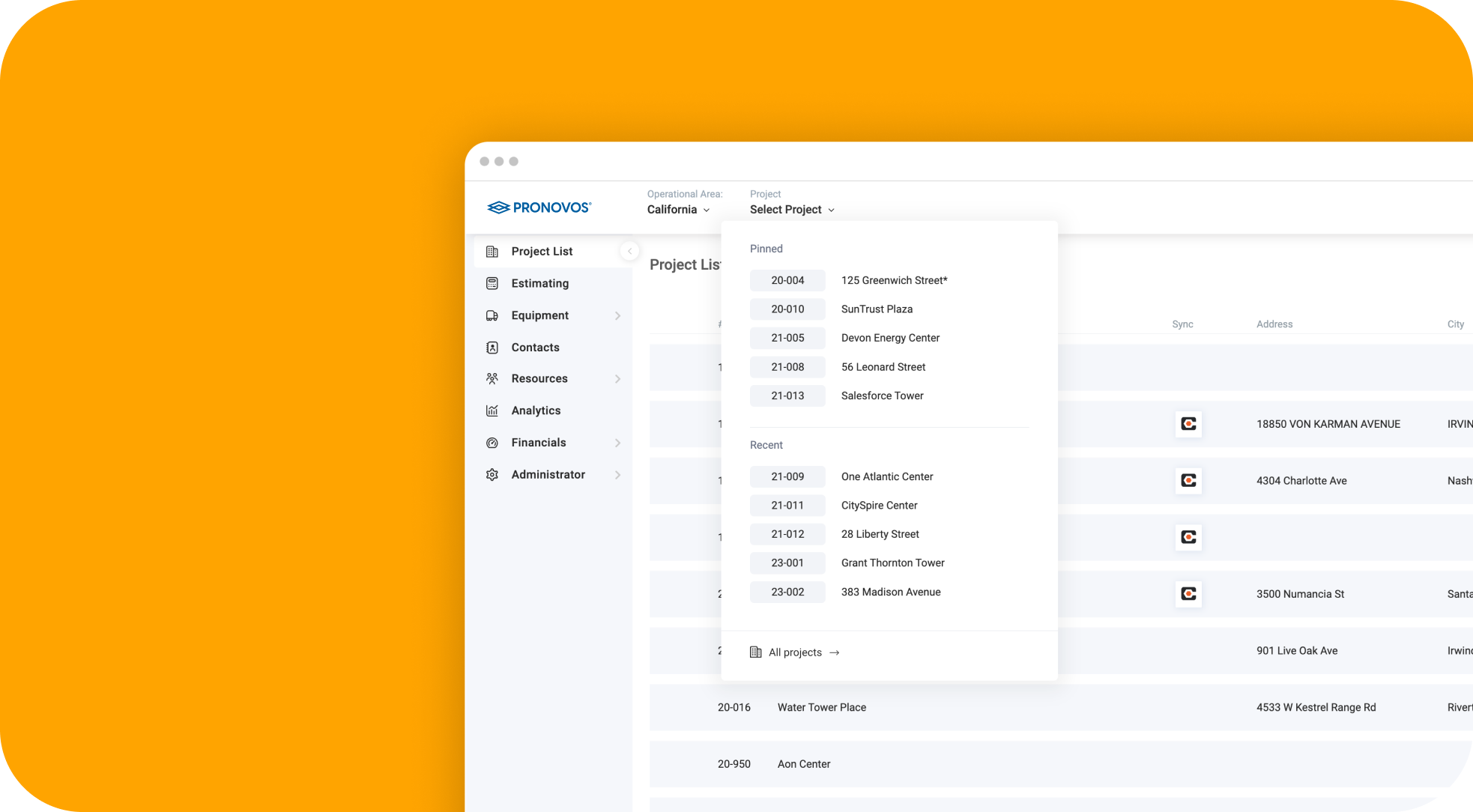

A well-maintained WIP schedule is more than just a reporting tool—it is a strategic instrument that equips project managers, executives, and external stakeholders with key insights to foresee potential problems and ensure that projects are completed on time and within budget. The right metrics—key performance indicators (KPIs)—form the basis of the WIP schedule and their accurate tracking and interpretation is crucial for project success.

In this article, we delve into these vital KPIs, providing a comprehensive understanding of their meaning, their calculation, and their role in the effective management of a construction project. Whether you’re a project manager, a construction accountant, or a stakeholder looking to optimize project outcomes, understanding these KPIs is essential.