At ProNovos, we talk every day with c-suite executives, project managers, superintendents, estimators and accountants about the construction metrics that matter most. Our platform puts the industry’s most-requested Key Performance Indicators (KPIs) at your fingertips, from the job site to the boardroom.

A

Financial Statements

Accounts Payable to Revenue

(Accounts Payable ÷ Total Revenue) x 100

Measures the relationship between a company’s accounts payable and its total revenue.

WIP

Actual Labor Rate

Total Labor Costs to Date ÷ Total Labor Hours to Date

The average hourly rate paid for labor on a project based on actual costs.

WIP

Approved Change Orders

Sum of all approved change order amounts

The total value of client-approved modifications to the original contract.

AR & AP

Accounts Receivable Aging

Categorize outstanding invoices into time buckets (e.g., 0-30 days, 31-60 days, 61-90 days, 90+ days)

A breakdown of accounts receivable by the length of time invoices have been outstanding.

Financial Statements

Asset Turnover

Total Revenue ÷ Average Total Assets

Indicates how efficiently a company uses its assets to generate revenue.

B

Revenue Forecast

Backlog

Total value of signed contracts – Revenue recognized from those contracts

The value of contracted projects that have not yet been completed or started.

WIP

Billed-to-Date

Sum of all invoices issued for the project

The total amount invoiced to the client for work completed on a project so far.

WIP

Budget Labor Rate

Budgeted Labor Costs ÷ Budgeted Labor Hours

The estimated average hourly rate for labor as per the project budget.

C

WIP

Cash Received to Date

Sum of all payments received from the client

The total amount of cash collected from the client for the project so far.

Cash Flow

Current Trial Balance

Sum of all debit balances = Sum of all credit balances

A financial report that lists the balances of all general ledger accounts at a specific point in time.

Financial Statements

Current Liabilities to Equity

Current Liabilities ÷ Shareholders’ Equity

Measures the proportion of current liabilities to shareholders’ equity.

Financial Statements

Current Month Costs

Sum of all costs recorded in the current month

The total costs incurred on the project during the current month.

Financial Statements

Current Month Profit

Current Month Revenue – Current Month Costs

The profit earned on the project during the current month.

Financial Statements

Current Month Revenue

Total of all billable work completed in the current month

The revenue recognized for the project during the current month.

Financial Statements

Current Ratio

Current Assets ÷ Current Liabilities

Indicates a company’s ability to pay short-term obligations within one year.

Financial Statements

Current to Total Assets

(Current Assets ÷ Total Assets) × 100

Shows the proportion of current assets to total assets.

D

Financial Statements

Days in Accounts Payable (AP)

(Accounts Payable ÷ Cost of Goods Sold) × 365

The average number of days it takes a company to pay its suppliers.

Financial Statements

Days in Accounts Receivable (AR)

(Accounts Receivable ÷ Total Revenue) × 365

The average number of days it takes to collect payment after a sale has been made.

Financial Statements

Days in Cash

(Cash and Cash Equivalents ÷ Operating Expenses) × 365

The number of days a company can continue to pay its operating expenses with its current cash balance.

Financial Statements

Days in Inventory

(Average Inventory ÷ Cost of Goods Sold) × 365

The average number of days it takes to turn inventory into sales.

Financial Statements

Debt to Equity

Total Liabilities ÷ Shareholders’ Equity

Measures the proportion of equity and debt used to finance a company’s assets.

E

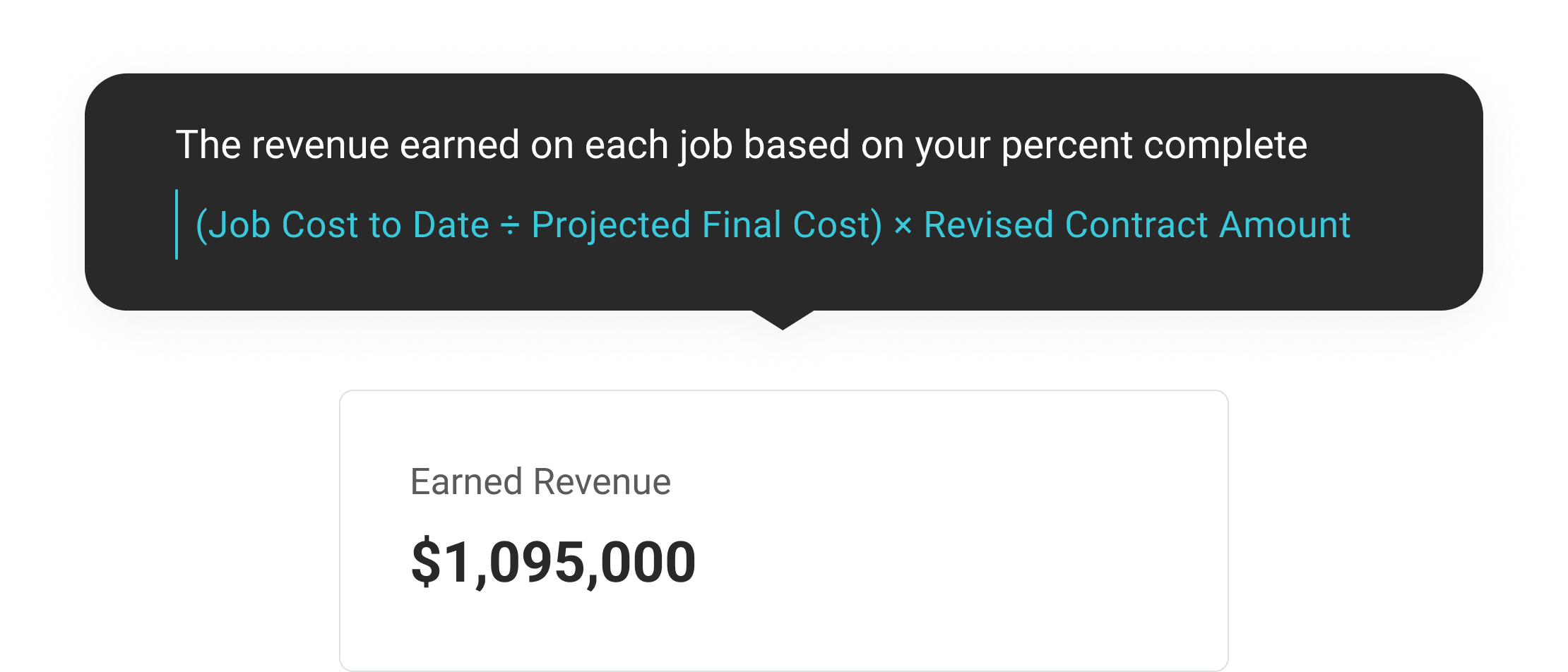

WIP | Cost Forecast

Earned Revenue

Total Contract Value × Percentage of Work Completed

The amount of revenue recognized based on the work completed to date.

Financial Statements

Equity to Overhead

Shareholders’ Equity ÷ Overhead Expenses

Measures the relationship between a company’s equity and its overhead expenses.

WIP

Estimated Change Orders

Sum of all estimated change order amounts

The total value of change orders that are anticipated but not yet approved.

F

Financial Statements

Fixed Asset Newness

Accumulated Depreciation ÷ Gross Fixed Assets

Indicates the average age of a company’s fixed assets.

Financial Statements

Fixed Asset Newness

Accumulated Depreciation ÷ Gross Fixed Assets

Indicates the average age of a company’s fixed assets.

Financial Statements

Fixed Asset Ratio

Net Sales ÷ Net Fixed Assets

Measures the efficiency of a company’s use of its fixed assets in generating revenue.

G

Financial Statements

G&A to Revenue

(General and Administrative Expenses ÷ Total Revenue) × 100

The proportion of general and administrative expenses to total revenue.

Financial Statements

Gross Profit Margin

(Revenue – Cost of Goods Sold) ÷ Revenue × 100

A measure of profitability that shows the percentage of revenue remaining after deducting direct costs.

H

WIP

Hours to Complete

Total Budgeted Hours – Hours Worked to Date

The estimated number of labor hours remaining to complete the project.

I

WIP

Internal Change Orders

Sum of all internal change order amounts

Changes to the project scope or budget that are absorbed internally and not billed to the client.

J

WIP | Cost Forecast

Job Cost to Date

Sum of all direct and indirect costs associated with the project

The total costs incurred on a project from its start to the current date.

WIP

Job Borrow

(Est Cost – Cost to Date)- (Contract Rev – Billed to Date)

The amount of cash borrowed from other projects or company resources to fund this project.

L

WIP

Labor Budget

Labor Hours Budget × Budget Labor Rate

The total budgeted cost for labor on the project.

WIP

Labor Costs to Date

Sum of all labor costs recorded to date

The total labor costs incurred on the project so far.

Cash Flow

Line of Credit

Typically a fixed amount set by the lender

The maximum amount of credit extended to a borrower by a lender, which can be drawn upon as needed.

WIP

Labor Hours Budget

Sum of estimated hours for all labor tasks

The total number of labor hours budgeted for the project.

N

Cash Flow

Net Cash

Total Cash Inflows – Total Cash Outflows

The difference between cash inflows and outflows over a specific period.

Financial Statements

Net Profit Margin

(Net Income ÷ Revenue) × 100

The percentage of revenue that remains as profit after all expenses are deducted.

Financial Statements

Net Worth to Assets

Shareholders’ Equity ÷ Total Assets

Measures the proportion of a company’s total assets that are owned outright by investors.

O

WIP

Open Commitments

(Sum of all issued PO ÷ subcontract values) – (Amounts billed ÷ paid to date)

The total value of purchase orders or subcontracts that have been issued but not yet fully billed or paid.

WIP

Operating Cycle

Days in Inventory + Days in Accounts Receivable

The average time between purchasing inventory and receiving cash from its sale.

WIP

Original Budget

Sum of all initially budgeted costs

The initial total cost budget for the project.

WIP

Original Contract

Sum of all initially contracted amounts

The initial agreed-upon contract value for the project.

WIP

Original Estimated Profit

Original Contract – Original Budget

The profit initially expected to be earned on the project.

WIP

Original Profit Margin

(Original Estimated Profit ÷ Original Contract) × 100

The initially expected profit as a percentage of the original contract value.

WIP

Outstanding AR

Total Billed to Date – Cash Received to Date

The total amount billed to the client but not yet paid.

WIP

Overhead Costs

Total Project Costs × Overhead Rate

The indirect costs allocated to the project.

WIP | Cost Forecast

Overbilling

Billed-to-Date – (Job Cost to Date + Recognized Profit)

The amount by which billings exceed costs plus estimated earnings on uncompleted contracts.

P

WIP

Percentage Billed

(Billed-to-Date ÷ Total Contract Value) × 100

The percentage of the total contract value that has been billed to the client.

WIP | Cost Forecast

Percentage Complete

(Earned Revenue ÷ Total Contract Value) × 100 or (Job Cost to Date ÷ Projected Final Cost) × 100

The proportion of work that has been finished on a project relative to the total scope.

WIP

Pending Change Orders

Sum of all pending change order amounts

The total value of change orders that have been submitted to the client but not yet approved.

WIP

Previous Month Cost

Sum of all costs recorded in the previous month

The total costs incurred on the project during the previous month.

WIP

Previous Month Profit

Previous Month Revenue – Previous Month Cost

The profit earned on the project during the previous month.

WIP

Previous Month Project Final Contract

Original Contract + Approved Change Orders (as of previous month end)

The total contract value including all approved change orders as of the end of the previous month.

WIP

Previous Month Project Final Cost

Costs to Date + Estimated Costs to Complete (as of previous month end)

The total estimated cost at completion as of the end of the previous month.

WIP

Previous Month Project Profit

Previous Month Project Final Contract – Previous Month Project Final Cost

The total estimated profit for the project as of the end of the previous month.

WIP

Previous Month Project Profit Margin

(Previous Month Project Profit ÷ Previous Month Project Final Contract) × 100

The estimated profit margin as of the end of the previous month.

WIP

Previous Month Revenue

Total of all billable work completed in the previous month

The revenue recognized for the project during the previous month.

WIP | Cost Forecast | Project Dashboard

Project Profit

Total Contract Value – Projected Final Cost

A project profit margin measures the percentage of profit earned from a project relative to its total revenue, indicating how efficiently the project was managed financially.

WIP | Cost Forecast

Projected Final Cost

Job Cost to Date + Estimated Cost to Complete

The estimated total cost of a project at completion, including all actual and forecasted costs.

WIP

Profit and Overhead Budget

Original Budget × (1 + Overhead Rate + Profit Rate)

The total budgeted amount for profit and overhead costs.

WIP

Profit to Date

Revenue to Date – Costs to Date

The actual profit earned on the project so far.

Q

Financial Statements

Quick Ratio

(Current Assets – Inventory) ÷ Current Liabilities

This ratio provides a more conservative measure of a company’s liquidity than the current ratio, focusing specifically on its ability to cover short-term obligations using only its most liquid assets.

R

WIP

Remaining to Bill

Total Contract Value – Billed-to-Date

The amount of the contract value that has not yet been billed to the client.

Financial Statements

Return on Assets (ROA)

(Net Income ÷ Average Total Assets) × 100

Measures how efficiently a company uses its assets to generate profit.

Financial Statements

Return on Equity (ROE)

(Net Income ÷ Shareholders’ Equity) × 100

Measures the profitability of a company in relation to shareholders’ equity.

Financial Statements

Revenue to Equity

Total Revenue ÷ Shareholders’ Equity

Measures the amount of revenue generated for each dollar of shareholders’ equity.

Financial Statements

Revised Budget

Original Budget + Approved Change Orders

The updated budget for a project after incorporating changes and adjustments to the original budget.

WIP

Revised Estimated Profit

Revised Contract Value – Revised Estimated Cost at Completion

The updated expected profit based on current project performance and forecasts.

WIP

Revised Profit Margin

(Revised Estimated Profit ÷ Revised Contract Value) × 100

The updated expected profit margin based on current project performance and forecasts.

T

WIP

Total Commitments

Costs to Date + Open Commitments

The sum of all costs incurred to date plus open commitments.

AR | AP

Total Outstanding

Sum of all unpaid customer invoices

The total amount of money owed to a company by its customers for goods or services delivered but not yet paid for.

U

WIP | Cost Forecast

Underbilling

(Job Cost to Date + Recognized Profit) – Billed-to-Date

The amount by which costs plus estimated earnings exceed billings on uncompleted contracts.

W

Financial Statements

Working Capital Turnover

Net Sales ÷ Average Working Capital

Measures how efficiently a company uses its working capital to generate sales.

Y

WIP

YTD Billing

Sum of all invoices issued in the current year

The total amount billed to the client in the current year to date.

WIP

YTD Costs

Sum of all costs recorded in the current year

The total costs incurred on the project in the current year to date.

WIP

YTD Revenue

Sum of all revenue recognized in the current year

The total revenue recognized for the project in the current year to date.

WIP

YTD Profit

YTD Revenue – YTD Costs

The total profit earned on the project in the current year to date.