In the construction industry, one critical aspect consistently calls for detailed attention: cash flow. Unlike many other industries, construction faces unique challenges like unpredictable payments, long payment periods, and retention. As a result, accurate cash flow forecasting in construction becomes not only a beneficial practice but a survival strategy. In this blog post, we’ll delve into these challenges and explore why streamlining a 13-week cash flow forecast will be a game-changer for your construction business.

Published August 4, 2023 . 3 mins read

Mastering Construction Cash Flow: Unlocking the Power of the 13-Week Forecast

Business

1. Unpredictable Payments

Construction payment schedules often hinge upon a chain of events that can cause significant unpredictability. The common ‘paid-when-paid’ practice means that contractors and subcontractors might not receive payments until their client has been paid, adding an extra degree of uncertainty.

Additionally, the payment release process often involves a long series of approvals and paperwork, further delaying receipt of funds. To add to the complexity, the inherent volatility of construction schedules, due to unforeseen circumstances like weather conditions or supply chain issues, can cause frequent changes in the projected payment dates. This amalgamation of factors often results in unpredictable cash inflows, making efficient cash flow management a herculean task.

2. Long Payment Periods

The construction industry is notorious for its long payment periods, often extending up to 90 days or more. These lengthy payment periods are further exacerbated by the common practice of monthly billing. In construction projects, firms typically bill their clients only once a month. This means if costs are incurred early in the billing cycle, companies might have to wait several weeks before they can bill for those costs, then further wait through the normal payment period before actually receiving the payment. This significant delay between expense and reimbursement can cause serious cash flow strains, especially for businesses juggling multiple projects.

Once a month

typical billing frequency in construction projects

3. Retention

The practice of retention presents another significant cash flow challenge in the construction industry. This is where a portion of the contractor’s payment (usually between 5-10%) is held back until the end of the project to ensure completion and satisfaction of work.

While retention can serve as a safety net for project owners, it places a substantial burden on contractors and subcontractors. This is primarily because they have to fund the ongoing operations, including labor, materials, and equipment, with a reduced cash inflow. In many cases, the retention amount may be held until several months after project completion, pending final inspections or resolution of any potential disputes. This delay in receiving the full payment for the job can significantly squeeze the cash flow, particularly for smaller firms or those operating on thin margins.

The 13-Week Cash Flow Forecast: A Powerful Tool

Given these unique challenges, the importance of effective cash flow management in the construction industry cannot be overstated. This is where the 13-week cash flow forecast comes into play.

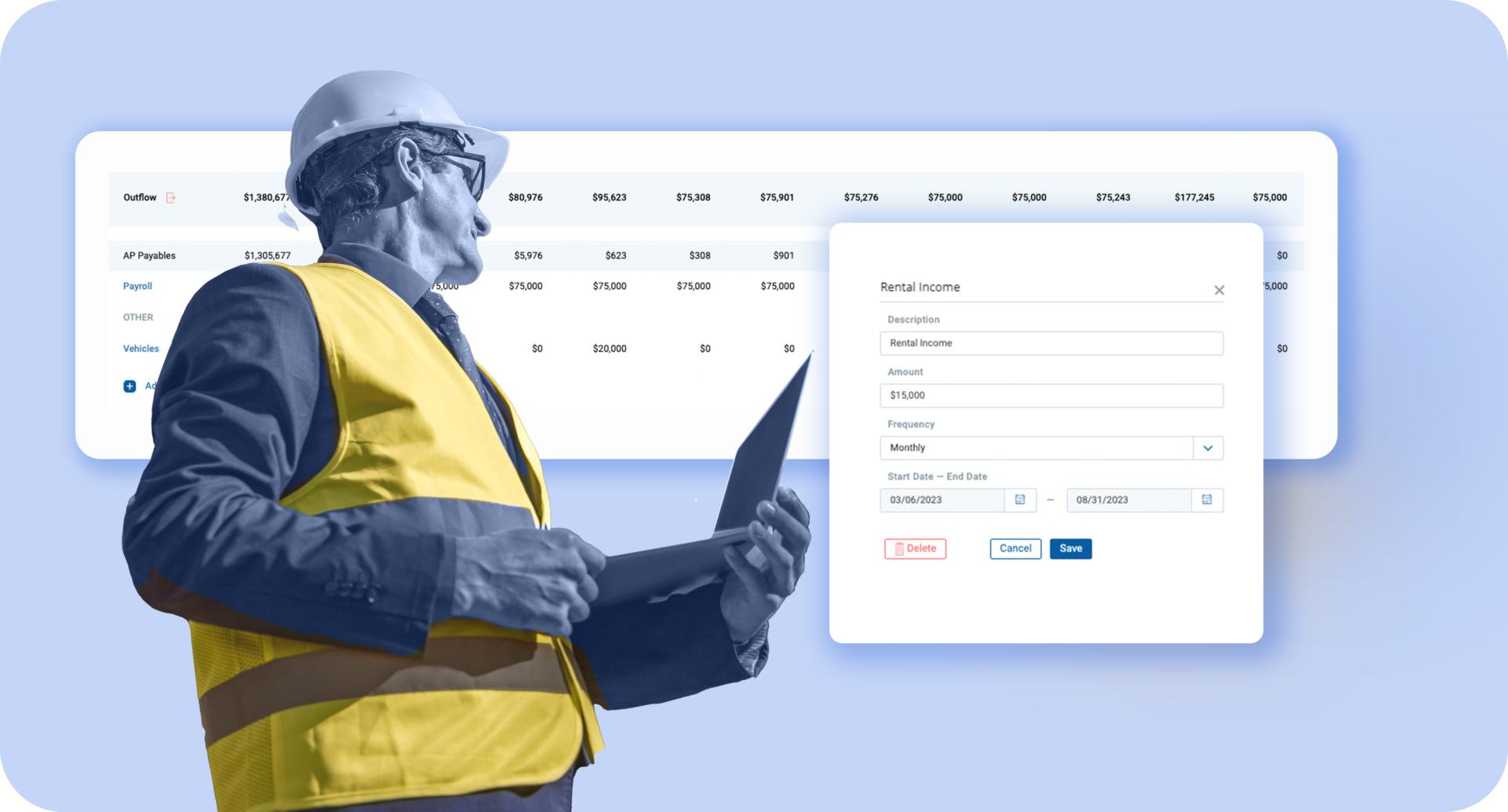

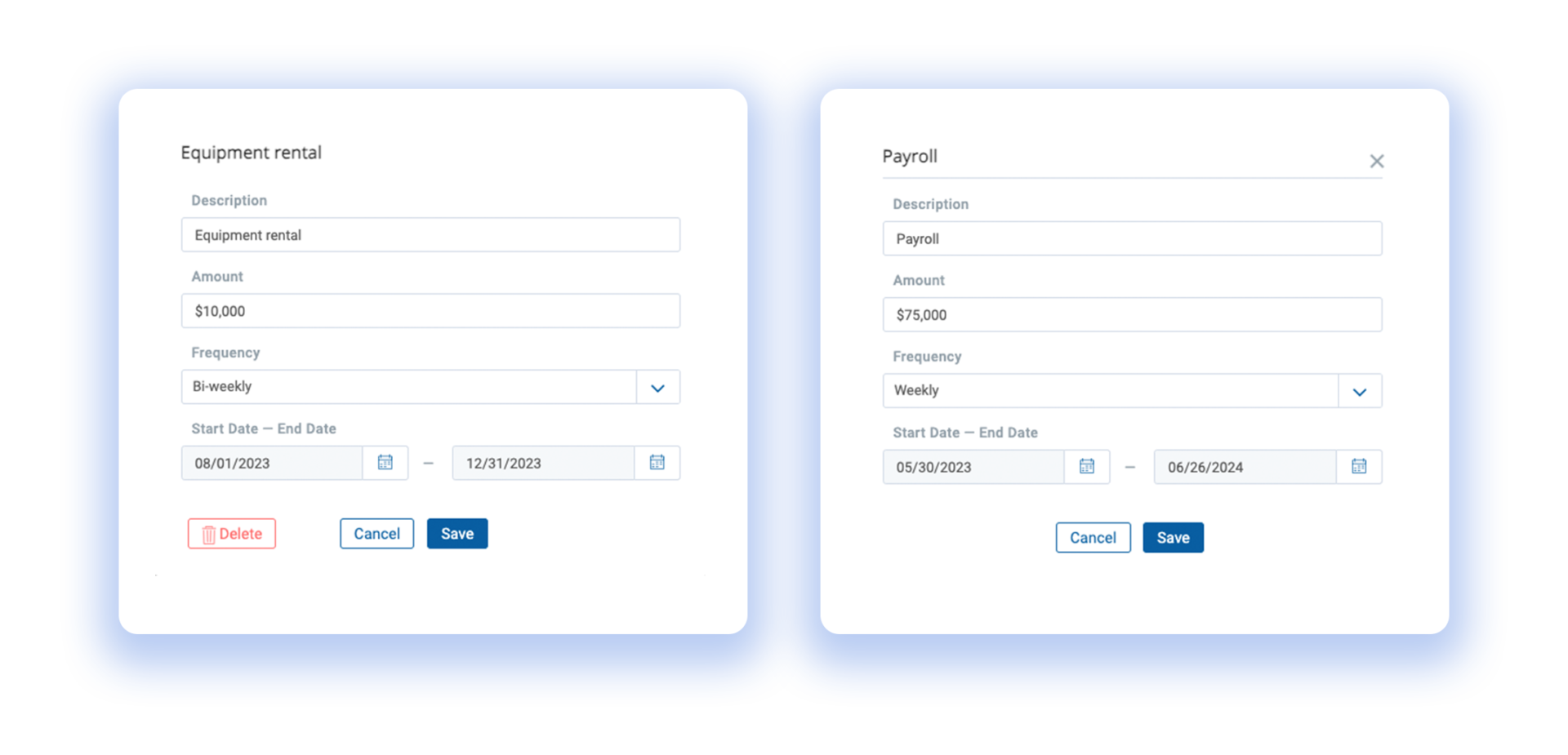

A 13-week cash flow forecast provides a detailed weekly overview of expected cash inflows and outflows over the next quarter. This time frame is long enough to help identify potential shortfalls and provide sufficient time for corrective actions, yet short enough to provide detailed, actionable data.

Here are the key benefits of a 13-week cash flow forecast:

- Visibility: It offers a granular view of your weekly cash flow, helping you understand exactly when and where your cash is coming in and going out. This can help pinpoint potential issues before they turn into bigger problems.

- Management of Cash Shortfalls: By projecting your cash flow three months out, you can anticipate potential shortfalls and make arrangements to bridge the gap, whether through delayed expenditures, negotiating longer payment terms, or securing additional funding.

- Strategic Decision-Making: With a detailed understanding of your near-term cash position, you can make informed decisions about taking on new projects, making capital investments, or hiring additional staff.

- Improved Relationships with Stakeholders: Accurate cash flow forecasting enhances confidence among your stakeholders, be it your suppliers, creditors, or employees. When they know that you can meet your financial obligations, it strengthens your business relationships and builds trust.

In conclusion, given the unique cash flow challenges in the construction industry, having a robust cash flow forecast is essential. Specifically, the 13-week cash flow forecast provides a detailed, actionable snapshot of your cash position, helping you navigate potential pitfalls, make informed decisions, and ultimately, drive the success and growth of your construction business.

Through a seamless integration with the accounting system, ProNovos enables users to streamline the cash flow forecasting process, schedule a time to see ProNovos live today.