With over three decades in the banking sector, including nearly 20 years working closely with construction industry clients, I’ve witnessed the perpetual scrutiny of construction businesses within banking circles. When evaluating or establishing financing relationships with contractors, bankers typically focus on several key indicators:

- Experience: Assessing the longevity of the business and its resilience through economic challenges.

- Character of Leadership: Evaluating the integrity and competence of owners, CFOs, Controllers, and the accounting team.

- Collateral: Considering assets beyond accounts receivable that can serve as security.

- Quality of Financial Statements: Emphasizing the importance of accurate and comprehensive financial reporting.

Regrettably, many contractors falter in providing high-quality financial information, despite efforts to educate them on banking expectations. The quality of financial data remains paramount in shaping a bank’s decision-making process.

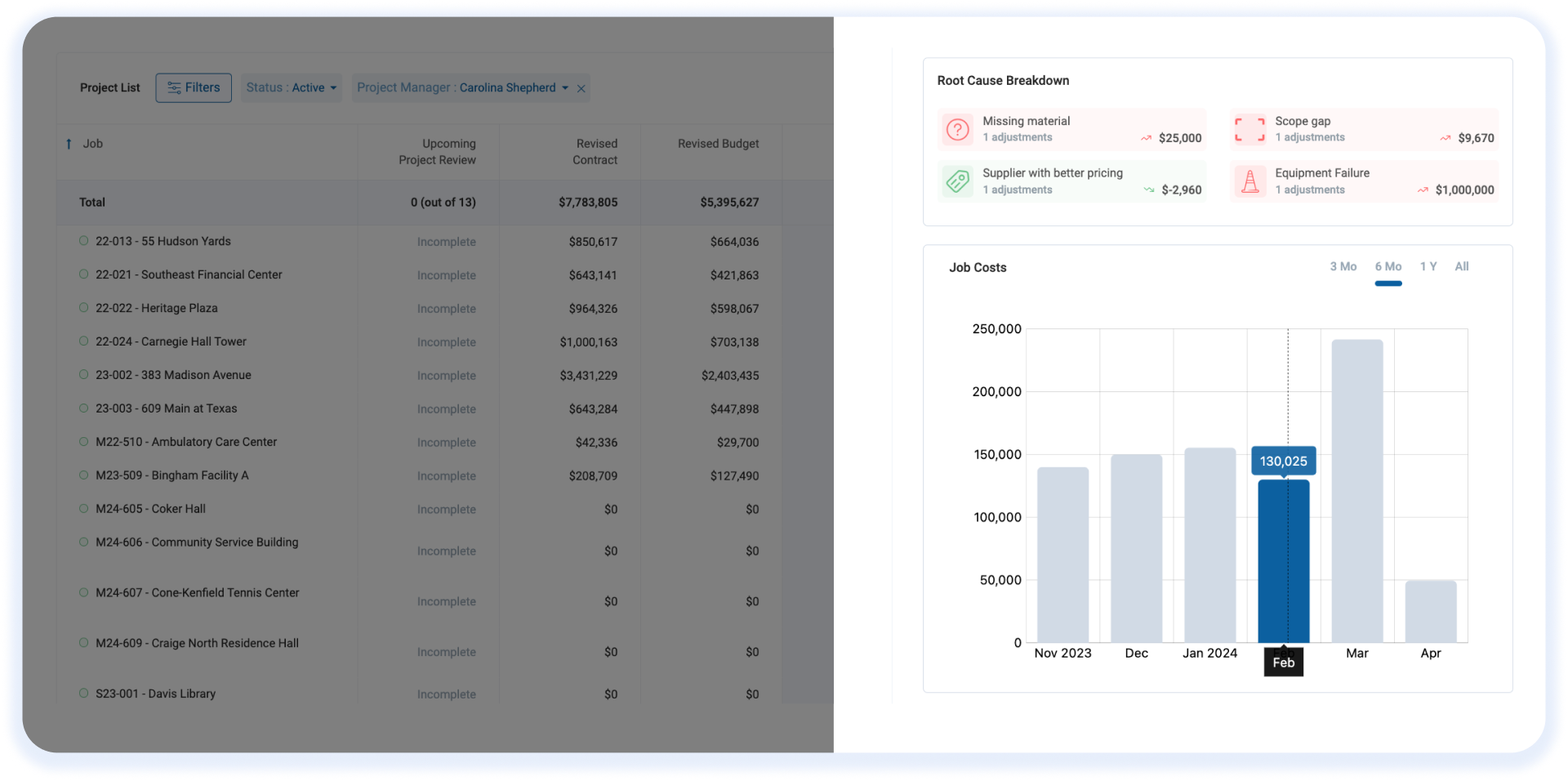

Establishing a productive partnership with a CPA for balanced and precise accounting, coupled with timely and accessible financial information, is crucial. Alongside a thorough examination of the Balance Sheet and Profit & Loss, bankers scrutinize the Work in Progress (WIP) Report meticulously.