In the construction industry, managing finances effectively is crucial to the success of any project. Among the various financial statements, the cash flow statement is an essential tool for tracking the movement of money into and out of your business. Unlike the income statement, which shows profitability, or the balance sheet, which provides a snapshot of assets and liabilities, the cash flow statement offers a real-time view of your company’s liquidity. It helps you understand how well your business can cover expenses, invest in new projects, and sustain long-term growth. Additionally, while the Work in Progress (WIP) report focuses on project-specific financial tracking, the cash flow statement provides a broader perspective on your company’s overall financial health. Understanding and utilizing this statement is key to ensuring your construction business remains financially stable and capable of meeting its obligations.

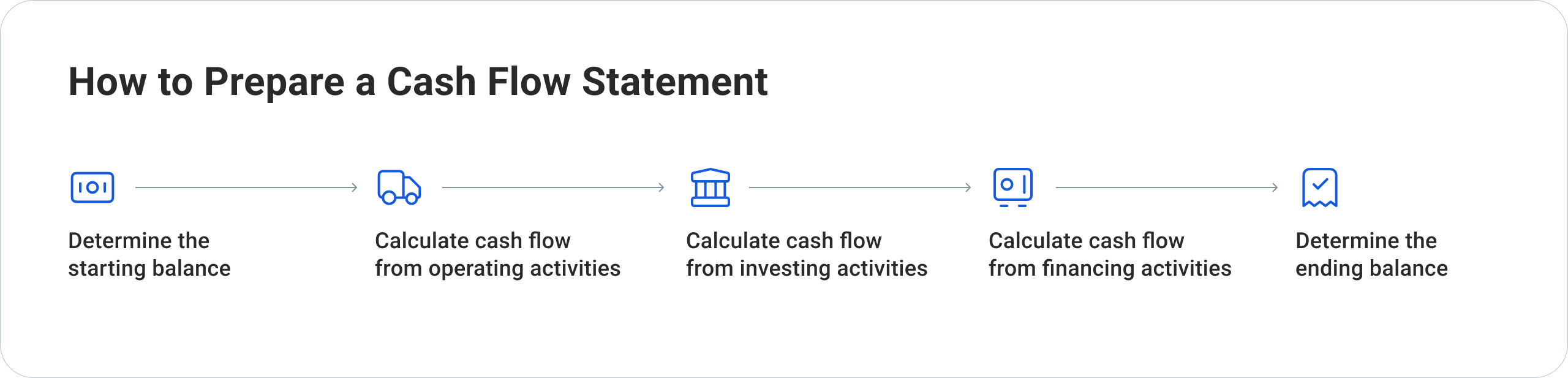

This article will explore the relevance of cash flow statements to the construction industry, detailing their importance in managing finances effectively. It will also break down the components of a cash flow statement, including operating, investing, and financing activities.