One of the most challenging concepts in the world of construction finance to comprehend is over/underbillings. It’s a crucial aspect of how revenue recognition works in the industry and a key metric that should be included in every contractor’s WIP report, as it directly impacts the balance sheet. Understanding over/underbillings can significantly influence the financial health and cash flow of a construction project, helping contractors manage their profitability and maintain accurate financial statements.

Published August 15, 2023 . 3 mins read

Decoding Over/Underbillings in Construction: Navigating the Maze of Revenue Recognition

Business

Unraveling the Revenue Recognition Process

In the construction industry, revenue recognition happens on a percentage complete basis. Simply put, the percentage of the project completed corresponds to the percentage of the total contract recognized as revenue. For instance, if a project is 40% complete, then the revenue stands at 40% of the total contract amount.

It’s important to note that while the revenue may closely mirror your percentage billed on the project, these two are completely independent metrics. They can often diverge, resulting in over or underbilling situations.

A Practical Illustration of Over/Underbillings

Let’s consider an example. Imagine a $1,000,000 construction contract, of which you have completed 40%. Therefore, your revenue equates to $400,000. However, suppose you have billed 50% of the contract, amounting to $500,000. In this scenario, the billed amount ($500,000) minus the revenue ($400,000) equals $100,000. This difference indicates an overbilling scenario.

Overbilling means the billed amount surpasses the revenue – a positive difference when subtracting the revenue from the billed amount. In contrast, underbilling occurs when the billed amount is less than the revenue, indicating a negative difference.

The Preference for Overbilling: A Cash Flow Perspective

In terms of managing a project’s cash flow, it’s almost always advantageous to be overbilled. Why so? Because revenue is contingent on the percentage complete, which typically equals the cost divided by the estimated final cost. Hence, overbilling suggests that billings are outpacing costs, which improves cash flow.

What is Job Borrow?

In construction accounting, job borrow refers to a situation where a contractor uses funds from one project (or job) to cover costs or pay for work on another project. This typically occurs when a contractor is overbilled on one project—meaning they have billed more than they have actually earned—and uses the excess funds from that overbilling to cover the costs of a different project. Often, the second project is underbilled or facing cash flow issues, making it reliant on the surplus cash generated from the overbilled project.

When a contractor overbills a project, they receive more cash than what has been earned based on the work completed to date. This creates a cash surplus, which can be used to “borrow” from the overbilled project to help fund other ongoing projects. While this practice is common, it can be risky, as it may lead to cash flow problems if the overbilled amount isn’t collected on time or if the actual progress of the project doesn’t align with the overbillings. Furthermore, it can distort financial reports, particularly the Work-in-Progress (WIP) schedule, making the contractor appear to be in a better financial position than they truly are.

The Intriguing Accounting Paradigm: Overbillings as Liability

Despite the preference for overbilling due to cash flow benefits, the accounting realm presents a paradox. Overbillings, although beneficial to cash flow, are classified as liabilities in accounting terms.

This classification is because overbilling technically implies you’ve billed for work you haven’t yet performed. The obligation to perform that work, yet to be carried out, represents a liability. You could think of overbilling as an interest-free loan from your client. You receive payment upfront, but you’ll pay it back later through the work you complete.

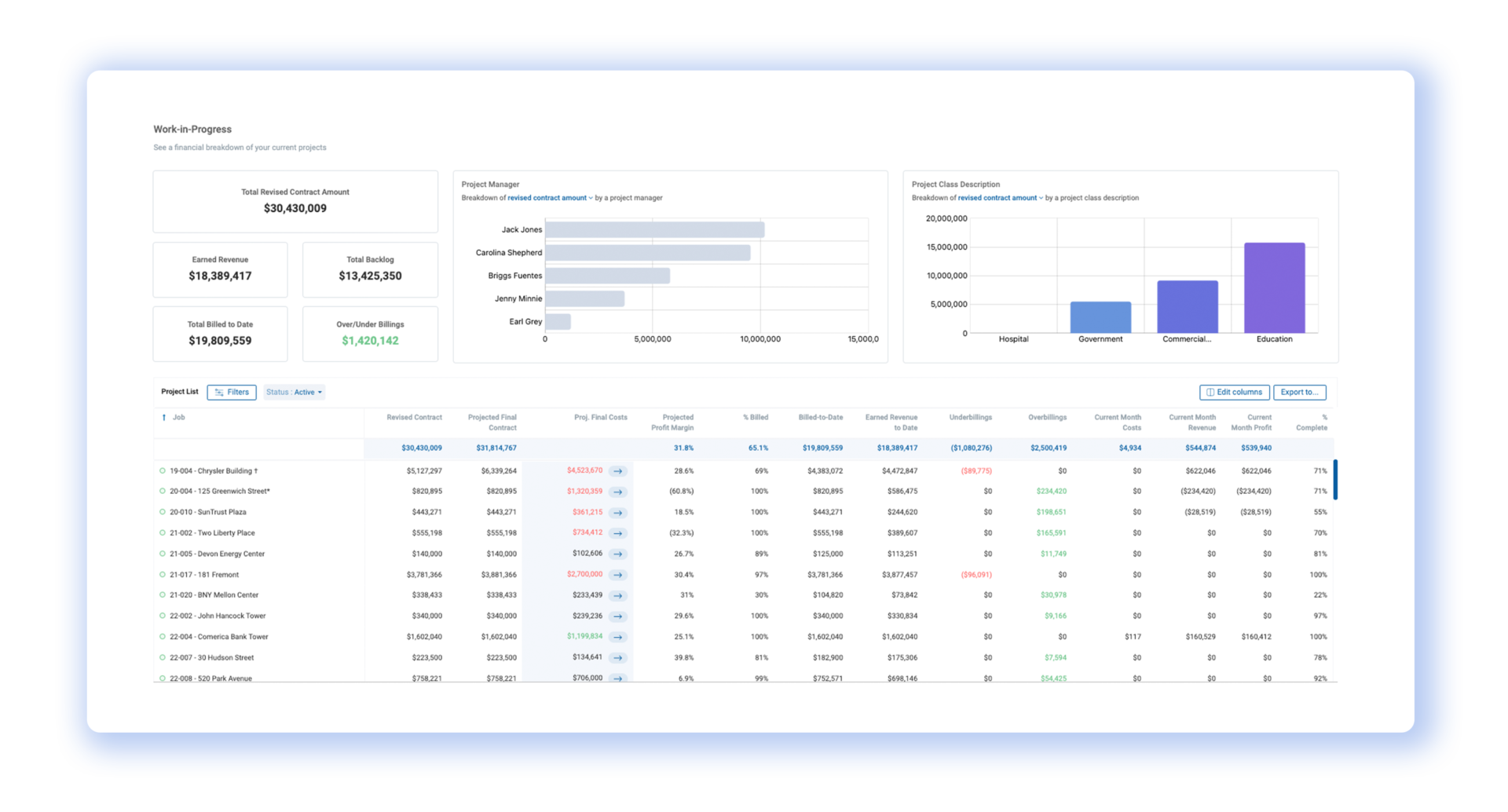

Wrapping Up: The Importance of Over/Underbilling Understanding

Highlighting this challenging yet important financial metric on the WIP Report and on individual project financial overviews will help create an understanding of why a project is overbilled or underbilled. The management of over/underbillings, combined with comprehensive knowledge of this concept, can help better manage project finances and cash flow.

In conclusion, over/underbillings are more than just numbers; they hold significant implications for project finances and cash flow management in the construction industry. Grasping the complexities of this concept provides a valuable tool for strategic financial decision-making and effective project management.